Business, 24.03.2021 17:00 travawnward

Parnevik Company has the following securities in its investment portfolio on December 31, 2020 (all securities were purchased in 2014): (1) 3,240 shares of Anderson Co. common stock which cost $61,560, (2) 10,460 shares of Munter Ltd. common stock which cost $585,760, and (3) 6,790 shares of King Company preferred stock which cost $278,390. The Fair Value Adjustment account shows a credit of $10,340 at the end of 2020.

In 2015, Parnevik completed the following securities transactions.

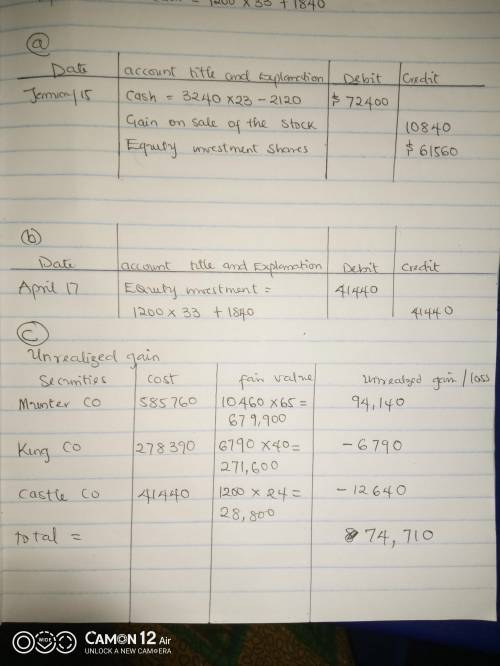

1. On January 15, sold 3,240 shares of Anderson’s common stock at $23 per share less fees of $2,120.

2. On April 17, purchased 1,200 shares of Castle’s common stock at $33 per share plus fees of $1,840.

On December 31, 2021, the market prices per share of these securities were Munter $65, King $40, and Castle $24. In addition, the accounting supervisor of Coronado told you that, even though all these securities have readily determinable fair values, Coronado will not actively trade these securities because the top management intends to hold them for more than one year.

Required:

a. Prepare the entry for the security sale on January 15, 2021.

b. Prepare the journal entry to record the security purchase on April 17, 2021.

c. Compute the unrealized gains or losses.

Answers: 3

Another question on Business

Business, 21.06.2019 15:30

What is "staffing level"? a) the practice of assigning the same number of workers to each department b) the average educational level attained by employees of a business c) the rank above cashier d) the number of workers assigned to jobs at a particular time

Answers: 2

Business, 21.06.2019 19:20

Which of the following statements is true? a. financial investment refers to the creation and expansion of business enterprisesb. economic investment refers to the creation and expansion of business enterprisesc. economic investment refers to the purchase of assets such as stocks, bonds, and real estated. both economic and financial investment refer to the purchase of assets such as stocks, bonds, and real estate

Answers: 2

Business, 22.06.2019 00:30

Aprice ceiling is “binding” if the price ceiling is set below the equilibrium price. suppose that the equilibrium price is $5. if a price ceiling is set at $6, this will not affect the market in any way since $5 remains a legally allowable price (since $5 < $6). a price ceiling of $6 is called a “non-binding” price ceiling. on the other hand, if the price ceiling is set at $4, the price ceiling is “binding” because the natural equilibrium price is $5 but that is no longer allowed. what happens when there is a binding price ceiling? at a price below the equilibrium price, quantity demanded exceeds quantity supplied. there is a shortage. normally, price increases eliminate shortages by increasing quantity supplied and decreasing quantity demanded. in this case, however, price increases are not allowed past the price ceiling. we therefore predict that the observed market price will be right at the price ceiling and there will be a permanent shortage. the observed quantity bought and sold will be dictated by the quantity supplied at the price ceiling. although consumers would like to buy more, there are no more units for sale

Answers: 1

Business, 22.06.2019 21:50

Assume that (i) setups need to be completed first; (ii) a setup can only start once the batch has arrived at the resource, and (iii) all flow units of a batch need to be processed at a resource before any of the units of the batch can be moved to the next resource. process step 1 molding 2 painting 3 dressing setup time 15 min. 30 min. no setup processing time 0.25 min./unit 0.15 min./unit 0.30 min./unit which batch size would minimize inventory without decreasing the process capacity?

Answers: 1

You know the right answer?

Parnevik Company has the following securities in its investment portfolio on December 31, 2020 (all...

Questions

English, 31.07.2019 09:30

History, 31.07.2019 09:30

Geography, 31.07.2019 09:30