Business, 24.03.2021 17:10 avagracegirlp17zx2

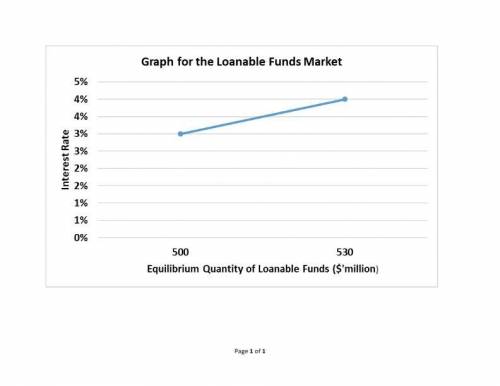

Suppose that a country is in a recession and the government decides to increase spending. It commissions a very large statue for $50 million. To pay for the statue, the government borrows all of the $50 million. As a result, the interest rate increases from 3% to 4%, and the equilibrium quantity of loanable funds increased from 500 million to 530 million.

Required:

Sketch a graph for the loanable funds market to represent this scenario.

Answers: 2

Another question on Business

Business, 22.06.2019 13:10

Lin corporation has a single product whose selling price is $136 per unit and whose variable expense is $68 per unit. the company’s monthly fixed expense is $32,400. required: 1. calculate the unit sales needed to attain a target profit of $5,000. (do not round intermediate calculations.) 2. calculate the dollar sales needed to attain a target profit of $8,400.

Answers: 3

Business, 22.06.2019 23:00

Which of the following represents an unlimited queue? a. toll booth serving automobiles on the interstateb. drive through lane at a fast food restaurantc. faculty office with limited seating during office hoursd. restaurant with no outside seating and limited capacity due to fire departments restrictionse. small barbershop with only 5 chairs for waiting customers

Answers: 3

Business, 23.06.2019 02:50

Kandon enterprises, inc., has two operating divisions; one manufactures machinery and the other breeds and sells horses. both divisions are considered separate components as defined by generally accepted accounting principles. the horse division has been unprofitable, and on november 15, 2018, kandon adopted a formal plan to sell the division. the sale was completed on april 30, 2019. at december 31, 2018, the component was considered held for sale. on december 31, 2018, the company’s fiscal year-end, the book value of the assets of the horse division was $415,000. on that date, the fair value of the assets, less costs to sell, was $350,000. the before-tax loss from operations of the division for the year was $290,000. the company’s effective tax rate is 40%. the after-tax income from continuing operations for 2018 was $550,000. required: 1. prepare a partial income statement for 2018 beginning with income from continuing operations. ignore eps disclosures. 2. prepare a partial income statement for 2018 beginning with income from continuing operations. assuming that the estimated net fair value of the horse division’s assets was $700,000, instead of $350,000. ignore eps disclosures.

Answers: 2

Business, 23.06.2019 10:30

This pie chart shows a sample weekly budget. in this budget, how much money is going toward optional expenses? $70 $75 $10 $35

Answers: 1

You know the right answer?

Suppose that a country is in a recession and the government decides to increase spending. It commiss...

Questions

Mathematics, 10.03.2021 01:50

English, 10.03.2021 01:50

Biology, 10.03.2021 01:50

Spanish, 10.03.2021 01:50

Mathematics, 10.03.2021 01:50

Biology, 10.03.2021 01:50

Mathematics, 10.03.2021 01:50

Mathematics, 10.03.2021 01:50

Mathematics, 10.03.2021 01:50

Mathematics, 10.03.2021 01:50

Mathematics, 10.03.2021 01:50