Business, 25.03.2021 21:20 babycakesmani

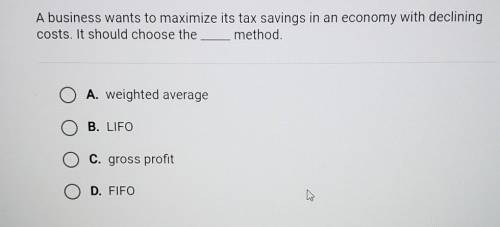

A business wants to maximize its tax savings in an economy with declining costs. It should choose the ___ method.

O A. weighted average

O B. LIFO

O c. gross profit

O D. FIFO hi

Answers: 2

Another question on Business

Business, 21.06.2019 18:30

Theodore is researching computer programming he thinks that this career has a great employment outlook so he’d like to learn if it’s a career in which he would excel what to skills are important for him to have and becoming a successful computer programmer

Answers: 3

Business, 22.06.2019 04:30

Annuity payments are assumed to come at the end of each payment period (termed an ordinary annuity). however, an exception occurs when the annuity payments come at the beginning of each period (termed an annuity due). what is the future value of a 13-year annuity of $2,800 per period where payments come at the beginning of each period? the interest rate is 9 percent. use appendix c for an approximate answer, but calculate your final answer using the formula and financial calculator methods. to find the future value of an annuity due when using the appendix tables, add 1 to n and subtract 1 from the tabular value. for example, to find the future value of a $100 payment at the beginning of each period for five periods at 10 percent, go to appendix c for n = 6 and i = 10 percent. look up the value of 7.716 and subtract 1 from it for an answer of 6.716 or $671.60 ($100 × 6.716)

Answers: 2

Business, 22.06.2019 12:20

Consider 8.5 percent swiss franc/u.s. dollar dual-currency bonds that pay $666.67 at maturity per sf1,000 of par value. it sells at par. what is the implicit sf/$ exchange rate at maturity? will the investor be better or worse off at maturity if the actual sf/$ exchange rate is sf1.35/$1.00

Answers: 2

Business, 22.06.2019 13:40

The cook corporation has two divisions--east and west. the divisions have the following revenues and expenses: east west sales $ 603,000 $ 506,000 variable costs 231,000 300,000 traceable fixed costs 151,500 192,000 allocated common corporate costs 128,600 156,000 net operating income (loss) $ 91,900 $ (142,000 ) the management of cook is considering the elimination of the west division. if the west division were eliminated, its traceable fixed costs could be avoided. total common corporate costs would be unaffected by this decision. given these data, the elimination of the west division would result in an overall company net operating income (loss)

Answers: 1

You know the right answer?

A business wants to maximize its tax savings in an economy with declining costs. It should choose th...

Questions

English, 16.01.2021 01:10

Mathematics, 16.01.2021 01:10

Mathematics, 16.01.2021 01:10

Mathematics, 16.01.2021 01:10

Chemistry, 16.01.2021 01:10

English, 16.01.2021 01:10

Chemistry, 16.01.2021 01:10

English, 16.01.2021 01:10