Business, 29.03.2021 23:40 Kyliehayden05

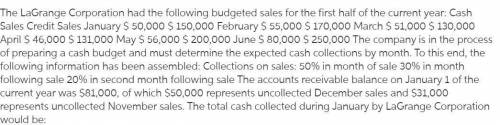

The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled: Collections on sales: 50% in month of sale 30% in month following sale 20% in second month following sale The accounts receivable balance on January 1 of the current year was $81,000, of which $50,000 represents uncollected December sales and $31,000 represents uncollected November sales. The total cash collected during January by LaGrange Corporation would be:

Answers: 2

Another question on Business

Business, 21.06.2019 22:30

Emily sold the following investments during the year: stock date purchased date sold sales price cost basis a. 1,000 shares dot com co. 03-21-2007 02-04-2018 $20,000 $5,000 b. 500 shares big box store 05-19-2017 01-22-2018 $8,200 $7,500 c. 300 shares lotta fun, inc. 10-02-2017 09-21-2018 $3,000 $4,500 d. 700 shares local gas co. 06-17-2017 11-11-2018 $14,000 $17,000 for each stock, calculate the amount and the nature of the gain or loss.

Answers: 3

Business, 22.06.2019 17:30

Emery pharmaceutical uses an unstable chemical compound that must be kept in an environment where both temperature and humidity can be controlled. emery uses 825 pounds per month of the chemical, estimates the holding cost to be 50% of the purchase price (because of spoilage), and estimates order costs to be $48 per order. the cost schedules of two suppliers are as follows: vendor 1 vendor 2 quantity price/lb quantity price/lb 1-499 $17 1-399 $17.10 500-999 $16.75 400-799 $16.85 1000+ $16.50 800-1199 $16.60 1200+ $16.25 (a) what is the economic order quantity for each supplier? (b) what quantity should be ordered and which supplier should be used? (c) the total cost for the most economic order sire is $

Answers: 2

Business, 22.06.2019 20:20

Xinhong company is considering replacing one of its manufacturing machines. the machine has a book value of $39,000 and a remaining useful life of 5 years, at which time its salvage value will be zero. it has a current market value of $49,000. variable manufacturing costs are $33,300 per year for this machine. information on two alternative replacement machines follows. alternative a alternative b cost $ 115,000 $ 117,000 variable manufacturing costs per year 22,900 10,100 1. calculate the total change in net income if alternative a and b is adopted. 2. should xinhong keep or replace its manufacturing machine

Answers: 1

You know the right answer?

The company is in the process of preparing a cash budget and must determine the expected cash collec...

Questions

Mathematics, 10.03.2021 20:20

English, 10.03.2021 20:20

Mathematics, 10.03.2021 20:20

Mathematics, 10.03.2021 20:20

English, 10.03.2021 20:20

Mathematics, 10.03.2021 20:20

Health, 10.03.2021 20:20

Mathematics, 10.03.2021 20:20

Arts, 10.03.2021 20:20

English, 10.03.2021 20:20