Business, 02.04.2021 04:20 Jazlinmoreno5683

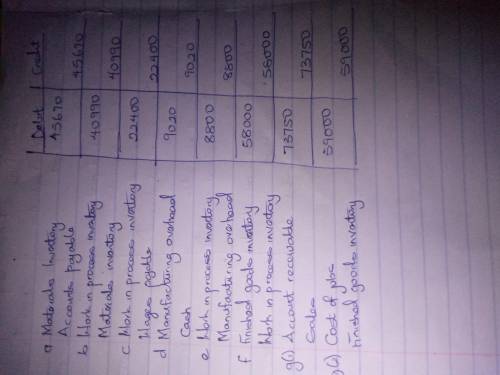

Journal Entries, T-Accounts Ehrling Brothers Company makes jobs to customer order. During the month of July, the following occurred: Materials were purchased on account for $45,670. Materials totaling $40,990 were requisitioned for use in producing various jobs. Direct labor payroll for the month was $22,400 with an average wage of $14 per hour. Actual overhead of $9,020 was incurred and paid in cash. Manufacturing overhead is charged to production at the rate of $5.50 per direct labor hour. Completed jobs costing $58,000 were transferred to Finished Goods. Jobs costing $59,000 were sold on account for $73,750. Make the entry to record the revenue from the sale first, followed by the entry to record the cost of the jobs. Beginning balances as of July 1 were: Materials Inventory $1,200 Work-in-Process Inventory 3,400 Finished Goods Inventory 2,630 Required: Message

Answers: 2

Another question on Business

Business, 21.06.2019 22:30

Acompany determined that the budgeted cost of producing a product is $30 per unit. on june 1, there were 80,000 units on hand, the sales department budgeted sales of 300,000 units in june, and the company desires to have 120,000 units on hand on june 30. the budgeted cost of goods sold for june would be

Answers: 1

Business, 22.06.2019 10:30

Trecek corporation incurs research and development costs of $625,000 in 2017, 30 percent of which relate to development activities subsequent to ias 38 criteria having been met that indicate an intangible asset has been created. the newly developed product is brought to market in january 2018 and is expected to generate sales revenue for 10 years. assume that a u.s.–based company is issuing securities to foreign investors who require financial statements prepared in accordance with ifrs. thus, adjustments to convert from u.s. gaap to ifrs must be made. ignore income taxes. required: (a) prepare journal entries for research and development costs for the years ending december 31, 2017, and december 31, 2018, under (1) u.s. gaap and (2) ifrs. (c) prepare the entry(ies) that trecek would make on the december 31, 2017, and december 31, 2018, conversion worksheets to convert u.s. gaap balances to ifrs.

Answers: 1

Business, 22.06.2019 13:00

Explain the relationship between consumers and producers in economic growth and activity

Answers: 1

Business, 22.06.2019 20:20

Digitalhealth electronics inc. is a company that builds diagnostic devices. it was the first company to develop a compact mri scanner by reconfiguring the components of the mri technology. this smaller and user-friendly version of the huge mri scanner created demand from small hospitals, nursing homes, and private practice doctors who were earlier dependent on the scanning machines in large hospitals. which of the following types of innovations does this scenario best illustrate? a. disruptive innovation b. incremental innovation c. radical innovation d. architectural innovation

Answers: 3

You know the right answer?

Journal Entries, T-Accounts Ehrling Brothers Company makes jobs to customer order. During the month...

Questions

Chemistry, 31.08.2019 04:30

Arts, 31.08.2019 04:30

Mathematics, 31.08.2019 04:30

Mathematics, 31.08.2019 04:30

Mathematics, 31.08.2019 04:30

Mathematics, 31.08.2019 04:30

Mathematics, 31.08.2019 04:30

Chemistry, 31.08.2019 04:30