Business, 02.04.2021 20:30 alazayjaime1423

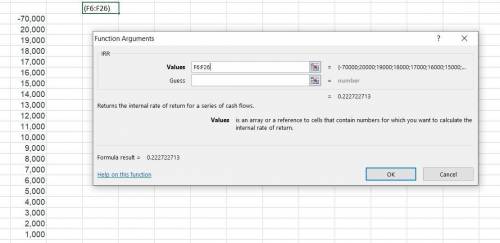

Nu Things, Inc., is considering investing in a business venture with the following anticipated cash flow results:

EOY Cash Flow

0 -$70,000

1 $20,000

2 $19,000

3 $18,000

4 $17,000

5 $16,000

6 $15,000

7 $14,000

8 $13,000

9 $12,000

10 $11,000

11 $10,000

12 $9,000

13 $8,000

14 $7,000

15 $6,000

16 $5,000

17 $4,000

18 $3,000

19 $2,000

20 $1,000

Assume MARR is 20 percent per year. Based on an internal rate of return analysis:

Determine the investment.

Answers: 2

Another question on Business

Business, 22.06.2019 11:30

What would you do as ceo to support the goals of japan airlines during the challenging economics that airlines face?

Answers: 1

Business, 23.06.2019 10:00

Governments sometimes erect barriers to trade other than tariffs and quotas. which of the following is not an example of this type of trade barrier? a. a requirement that the employees of domestic firms that engage in foreign trade pay income taxes b. restrictions on imports for national security reasons c. a requirement that imports meet health and safety requirements d. a requirement that the u.s. government buy military uniforms only from u.s. manufacturers

Answers: 2

Business, 23.06.2019 14:30

After four years aspen earned 510$ in simple interest from a cd into which she initially deposited $3000 what was the annual interest rate of the cd

Answers: 3

You know the right answer?

Nu Things, Inc., is considering investing in a business venture with the following anticipated cash...

Questions

Chemistry, 14.04.2021 02:50

Mathematics, 14.04.2021 02:50

Chemistry, 14.04.2021 02:50

English, 14.04.2021 02:50

Advanced Placement (AP), 14.04.2021 02:50

Mathematics, 14.04.2021 02:50

Mathematics, 14.04.2021 02:50

English, 14.04.2021 02:50