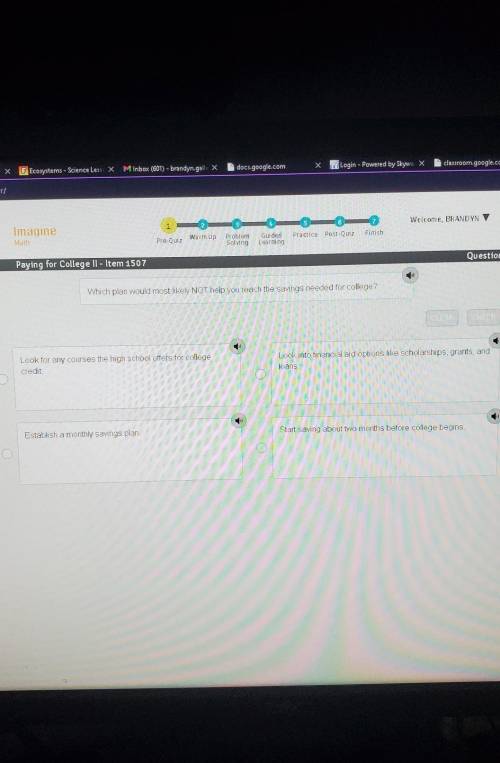

Which plan would most likely NOT help you reach the savings needed for college?

...

Business, 16.04.2021 18:30 deontarr6853

Which plan would most likely NOT help you reach the savings needed for college?

Answers: 3

Another question on Business

Business, 21.06.2019 17:30

If you want to compare two different investments, what should you calculate

Answers: 2

Business, 21.06.2019 21:00

Jurvin enterprises is a manufacturing company that had no beginning inventories. a subset of the transactions that it recorded during a recent month is shown below. $76,700 in raw materials were purchased for cash. $71,400 in raw materials were used in production. of this amount, $66,300 was for direct materials and the remainder was for indirect materials. total labor wages of $151,700 were incurred and paid. of this amount, $134,300 was for direct labor and the remainder was for indirect labor. additional manufacturing overhead costs of $126,300 were incurred and paid. manufacturing overhead of $126,800 was applied to production using the company's predetermined overhead rate. all of the jobs in process at the end of the month were completed. all of the completed jobs were shipped to customers. any underapplied or overapplied overhead for the period was closed to cost of goods sold.required: 1. post the above transactions to t-accounts.2. determine the cost of goods sold for the period.

Answers: 1

Business, 22.06.2019 07:00

Bridgeport company began operations at the beginning of 2018. the following information pertains to this company. 1. pretax financial income for 2018 is $115,000. 2. the tax rate enacted for 2018 and future years is 40%. 3. differences between the 2018 income statement and tax return are listed below: (a) warranty expense accrued for financial reporting purposes amounts to $7,500. warranty deductions per the tax return amount to $2,200. (b) gross profit on construction contracts using the percentage-of-completion method per books amounts to $94,700. gross profit on construction contracts for tax purposes amounts to $67,100. (c) depreciation of property, plant, and equipment for financial reporting purposes amounts to $61,800. depreciation of these assets amounts to $75,700 for the tax return. (d) a $3,600 fine paid for violation of pollution laws was deducted in computing pretax financial income. (e) interest revenue recognized on an investment in tax-exempt municipal bonds amounts to $1,500. 4. taxable income is expected for the next few years. (assume (a) is short-term in nature; assume (b) and (c) are long-term in nature.) (a) prepare the reconciliation schedule for 2017 and future years. (b) prepare the journal entry to record income tax expense for 2017. (c) prepare the income tax expense section of the income statement beginning with “income before income taxes.” (d) determine how the deferred taxes will appear on the balance sheet at the end of 2017.

Answers: 1

You know the right answer?

Questions

History, 13.09.2020 21:01

Mathematics, 13.09.2020 21:01

Mathematics, 13.09.2020 22:01

Biology, 13.09.2020 22:01

English, 13.09.2020 22:01

Mathematics, 13.09.2020 22:01

History, 13.09.2020 22:01

Geography, 13.09.2020 22:01

Mathematics, 13.09.2020 22:01

Mathematics, 13.09.2020 22:01

Spanish, 13.09.2020 22:01

Mathematics, 13.09.2020 22:01

Mathematics, 13.09.2020 22:01

Mathematics, 13.09.2020 22:01

Health, 13.09.2020 22:01

Mathematics, 13.09.2020 22:01

Mathematics, 13.09.2020 22:01

Mathematics, 13.09.2020 22:01

Mathematics, 13.09.2020 22:01

History, 13.09.2020 22:01