1

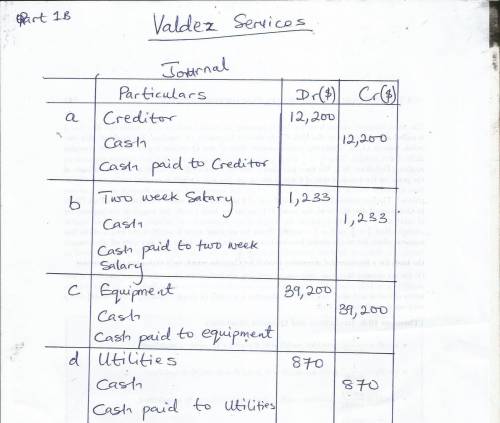

following are the transactions for valdez services.

following are the transactions fo...

Business, 25.08.2019 20:00 ruffnekswife

1

following are the transactions for valdez services.

following are the transactions for valdez services.

a.

the company paid $12,200 cash for payment on a 16-month old liability for office supplies.

b.

the company paid $1,233 cash for the just completed two-week salary of the receptionist.

c.

the company paid $39,200 cash for equipment purchased.

d.

the company paid $870 cash for this month's utilities.

e.

owner (valdez withdrew $4,500 cash from the company for personal use.

examine the above transactions and

1

following are the transactions for valdez services.

following are the transactions for valdez services.

a.

the company paid $12,200 cash for payment on a 16-month old liability for office supplies.

b.

the company paid $1,233 cash for the just completed two-week salary of the receptionist.

c.

the company paid $39,200 cash for equipment purchased.

d.

the company paid $870 cash for this month's utilities.

e.

owner (valdez withdrew $4,500 cash from the company for personal use.

examine the above transactions and identify those that create expenses for valdez services. (you may select more than one answer. click the box with a check mark for correct answers and click to empty the box for the wrong answers.

transaction

a.

transaction

b.

transaction

c.

transaction

d.

transaction

e.

prepare general journal entries to record those transactions that created expenses in the above given order.

2

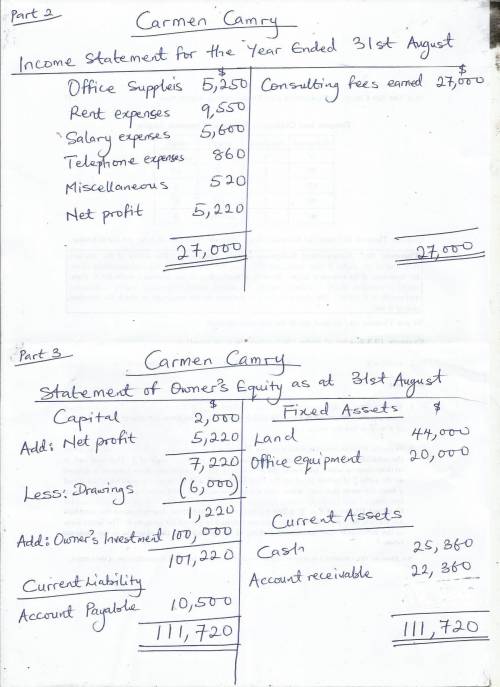

carmen camry operates a consulting firm called today. on august 31, the company's records show the following accounts and amounts for the month of august. use this information to prepare an august income statement for the business.

cash

$

25,360

c. camry, withdrawals

$

6,000

accounts receivable

22,360

consulting fees earned

27,000

office supplies

5,250

rent expense

9,550

land

44,000

salaries expense

5,600

office equipment

20,000

telephone expense

860

accounts payable

10,500

miscellaneous expense

520

c. camry, capital, july 31

2,000

owner investment made on august 4

100,000

3

carmen camry operates a consulting firm called today. on august 31, the company's records show the following accounts and amounts for the month of august. use this information to prepare an august statement of owner's equity for today.

cash

$

25,360

c. camry, withdrawals

$

6,000

accounts receivable

22,360

consulting fees earned

27,000

office supplies

5,250

rent expense

9,550

land

44,000

salaries expense

5,600

office equipment

20,000

telephone expense

860

accounts payable

10,500

miscellaneous expense

520

c. camry, capital, july 31

2,000

owner investment made on august 4

100,000

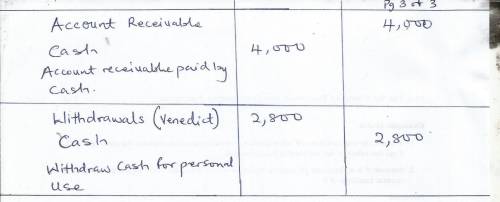

4

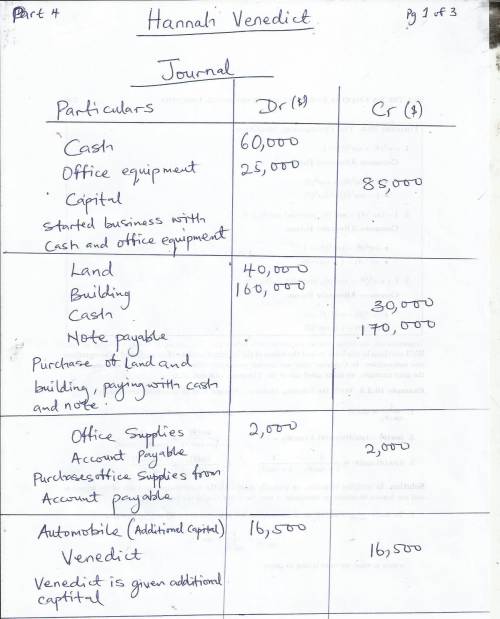

business transactions completed by hannah venedict during the month of september are as follows.

a.

venedict invested $60,000 cash along with office equipment valued at $25,000 in a new sole proprietorship named hv consulting.

b.

the company purchased land valued at $40,000 and a building valued at $160,000. the purchase is paid with $30,000 cash and a long-term note payable for $170,000.

c.

the company purchased $2,000 of office supplies on credit.

d.

venedict invested her personal automobile in the company. the automobile has a value of $16,500 and is to be used exclusively in the business.

e.

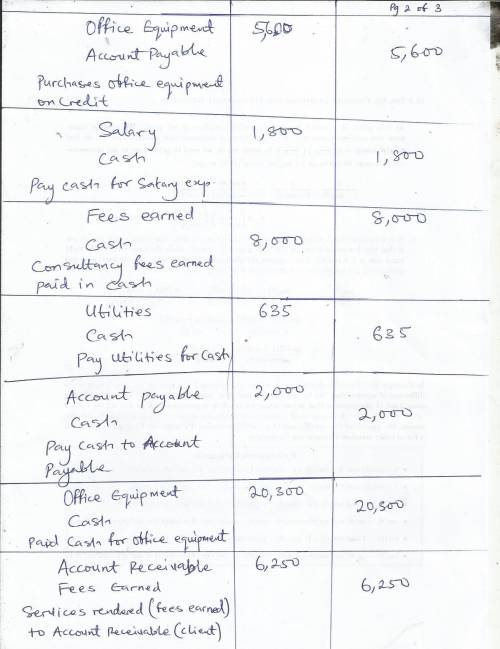

the company purchased $5,600 of additional office equipment on credit.

f.

the company paid $1,800 cash salary to an assistant.

g.

the company provided services to a client and collected $8,000 cash.

h.

the company paid $635 cash for this month's utilities.

i.

the company paid $2,000 cash to settle the account payable created in transaction

c.

j.

the company purchased $20,300 of new office equipment by paying $20,300 cash.

k.

the company completed $6,250 of services for a client, who must pay within 30 days.

l.

the company paid $1,800 cash salary to an assistant.

m.

the company received $4,000 cash in partial payment on the receivable created in transaction k.

n.

venedict withdrew $2,800 cash from the company for personal use.

required:

required:

1.

prepare general journal entries to record these transactions using the following titles: cash (101; accounts receivable (106; office supplies (108; office equipment (163; automobiles (164; building (170; land (172; accounts payable (201; notes payable (250; h. venedict, capital (301; h. venedict, withdrawals (302; fees earned (402; salaries expense (601; and utilities expense (602.

Answers: 1

Another question on Business

Business, 21.06.2019 16:00

Corey is trying to save money to buy a new tv. he invests $800 into an account paying 6.5% simple interest. for how long must he save if the tv costs $950? a. 2 years b. 3 years c. 4 years d. 5 years

Answers: 1

Business, 22.06.2019 02:30

Based on the supply and demand theory, why do medical doctors earn higher wages than child-care workers?

Answers: 1

Business, 22.06.2019 09:40

Wilson center is a private not-for-profit voluntary health and welfare entity. during 2017, it received unrestricted pledges of $638,000, 65 percent of which were payable in 2017, with the remainder payable in 2018 (for use in 2018). officials estimate that 14 percent of all pledges will be uncollectible. a. how much should wilson center report as contribution revenue for 2017? b. in addition, a local social worker, earning $20 per hour working for the state government, contributed 600 hours of time to wilson center at no charge. without these donated services, the organization would have hired an additional staff person. how should wilson center record the contributed service?

Answers: 2

Business, 22.06.2019 14:30

crow design, inc. is a web site design and consulting firm. the firm uses a job order costing system in which each client is a different job. crow design assigns direct labor, licensing costs, and travel costs directly to each job. it allocates indirect costs to jobs based on a predetermined overhead allocation rate, computed as a percentage of direct labor costs. direct labor hours (professional) 6,250 hours direct labor costs ($1,800,000 support staff salaries ,000 computer ,000 office ,000 office ,000 in november 2012, crow design served several clients. records for two clients appear here: delicious treats mesilla chocolates direct labor 700 hours 100 hours software licensing $ 4,000 $400 travel costs 8,000 1. compute crow design’s direct labor rate and its predetermined indirect cost allocation rate for 2012. 2. compute the total cost of each job. 3. if simone wants to earn profits equal to 50% of service revenue, how much (what fee) should she charge each of these two clients? 4. why does crow design assign costs to jobs?

Answers: 2

You know the right answer?

Questions

Mathematics, 24.06.2019 05:10

Mathematics, 24.06.2019 05:10

Mathematics, 24.06.2019 05:10

Mathematics, 24.06.2019 05:10

Mathematics, 24.06.2019 05:20