Business, 06.11.2019 18:31 michealsfamily

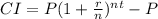

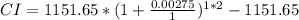

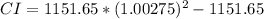

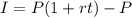

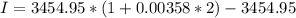

your fixed expenses are $1,151.65/month. you saved 4 months' worth in an emergency fund, investing 25% in a savings account at a 3.3% apr and the rest in a 60-day cd at a 4.3% apr. how much total interest accrues over 60 days?

$43.38

$30.67

$32.23

$41.04

Answers: 3

Another question on Business

Business, 22.06.2019 01:50

Which value describes the desire to be one’s own boss? a. autonomy b. status c. security d. entrepreneurship

Answers: 2

Business, 22.06.2019 17:00

Vincent is interested in increasing his earning potential upon completing his internship at a major accounting firm. which option can immediately boost his career in the intended direction? b. complete a certification from a professional organization c. complete a new four-year undergraduate program in a related field d. complete a two-year associate degree in a related field e. complete an online course in accounting

Answers: 3

Business, 22.06.2019 23:40

Gdp has grown in a country at 3% per year for the last 20 years. the labor force has grown at 2% per year and the quantity of physical capital has grown at 4% per year. a 1% increase in average physical capital per worker (other things equal) raises productivity by 0.3%. average education has not changed. how much has growing physical capital per worker contributed to productivity growth in this country? choose the correct answer from the following choices, and then select the submit answer button. answer choices 0.3% 0.6% 3.0% 6.0%

Answers: 1

Business, 23.06.2019 01:30

James jones is the owner of a small retail business operated as a sole proprietorship. during 2017, his business recorded the following items of income and expense: revenue from inventory sales $ 147,000 cost of goods sold 33,500 business license tax 2,400 rent on retail space 42,000 supplies 15,000 wages paid to employees 22,000 payroll taxes 1,700 utilities 3,600 compute taxable income attributable to the sole proprietorship by completing schedule c to be included in james’s 2017 form 1040. compute self-employment tax payable on the earnings of james’s sole proprietorship by completing a 2017 schedule se, form 1040. assume your answers to parts a and b are the same for 2018. further assume that james's business is not a service business, and that it has $155,000 unadjusted basis in tangible depreciable property. calculate james's 2018 section 199a deduction.

Answers: 1

You know the right answer?

your fixed expenses are $1,151.65/month. you saved 4 months' worth in an emergency fund, investing 2...

Questions

Mathematics, 15.01.2021 03:10

Mathematics, 15.01.2021 03:10

English, 15.01.2021 03:10

Mathematics, 15.01.2021 03:10

Mathematics, 15.01.2021 03:10

Mathematics, 15.01.2021 03:10

Mathematics, 15.01.2021 03:10

Mathematics, 15.01.2021 03:10

Biology, 15.01.2021 03:10

Mathematics, 15.01.2021 03:10

History, 15.01.2021 03:10

Mathematics, 15.01.2021 03:10