Business, 26.04.2021 21:40 kainagoicoowntpi

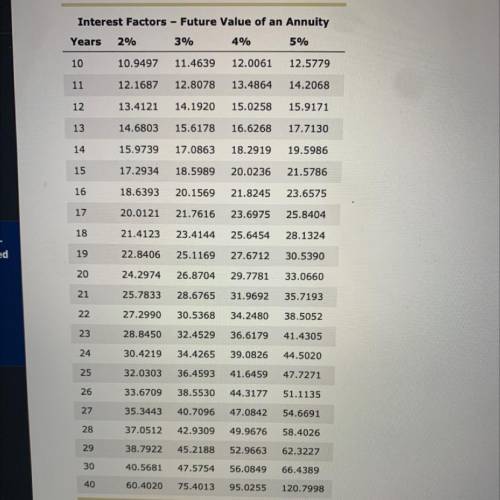

Madeline wants to see how much her savings would earn using different investment tactics. She plans to invest 3,000 every year for 40 years. She has found an investment account that earns 5% per year. She is in a 20% income tax bracket. Using the previous table, complete the following table to show Madeline the effect of different options that are available to her, round your answer to the nearest dollar.

Answers: 2

Another question on Business

Business, 21.06.2019 21:50

Discuss how the resource-based view (rbv) of the firm combines the two perspectives of (1) an internal analysis of a firm and (2) an external analysis of its industry and its competitive environment. include comments on the different types of firm resources and how these resources can be used by a firm to build sustainable competitive advantages.

Answers: 3

Business, 22.06.2019 12:50

In june 2009, at the trough of the great recession, the bureau of labor statistics announced that of all adult americans, 140,196,000 were employed, 14,729,000 were unemployed and 80,729,000 were not in the labor force. use this information to calculate: a. the adult population b. the labor force c. the labor-force participation rate d. the unemployment rate

Answers: 3

Business, 22.06.2019 13:30

The fiscal 2016 financial statements of nike inc. shows average net operating assets (noa) of $8,450 million, average net nonoperating obligations (nno) of $(4,033) million, average total liabilities of $9,014 million, and average equity of $12,483 million. the company's 2016 financial leverage (flev) is: select one: a. (0.477) b. (0.559 c. (0.323) d. (0.447) e. there is not enough information to determine the ratio.

Answers: 2

Business, 22.06.2019 17:50

Abc factory produces 24,000 units. the cost sheet gives the following information: direct materials rs. 1,20,000direct labour rs. 84,000variable overheads rs. 48,000semi variable overheads rs. 28,000fixed overheads rs. 80,000total cost rs. 3,60,000presently the product is sold at rs. 20 per unit.the management proposes to increase the production by 3,000 units for sales in the foreign market . it is estimated that semi variable overheads will increase by rs. 1,000. but the product will be sold at rs. 14 per unit in the foreign market. however, no additional capital expenditure will be incurredq-1. what is present profit of the company ? q-2. what is proposed profit of the company in new market? q-3.what is suggestion for new makret proposal whether proposal accept or not

Answers: 1

You know the right answer?

Madeline wants to see how much her savings would earn using different investment tactics. She plans...

Questions

Mathematics, 04.08.2019 10:50

Mathematics, 04.08.2019 10:50

Geography, 04.08.2019 10:50

Mathematics, 04.08.2019 10:50

English, 04.08.2019 10:50

Mathematics, 04.08.2019 10:50

Mathematics, 04.08.2019 10:50

Mathematics, 04.08.2019 10:50

Chemistry, 04.08.2019 10:50

English, 04.08.2019 10:50