Business, 29.04.2021 22:50 Uhmjujiooo45701

PLEASE ANSWER ASAP WILL GIVE BRAINLIEST AN LOT OF POINTS

Frugala is pleased when Sylvestor puts $2,000 into 10-year state bonds and $3,000 into 5-year AAA-rated bonds in Steady Hand Hardware, Inc. He buys the four state bonds at a 5 percent interest rate and the three Steady Hand bonds at a 6.5 percent rate. Sylvestor also buys $1,500 worth of blue chip stocks, and $800 worth of stock in a promising new sportswear company that reinvests its earnings in new growth.

1. (a) What is the maturity for each of the bond groups Sylvestor buys?

(b) The coupon rate?

(c) The par value?

2. (a) Which of Sylvestor’s stocks are traded over the counter?

(b) on the NYSE?

3. (a) Which of Sylvestor’s new investments are municipal bonds?

(b) Corporate bonds?

4. For which bond purchase did Frugala probably consult Standard & Poor’s or Moody’s?

5. From which stock may Sylvestor expect capital gains rather than dividends?

Answers: 1

Another question on Business

Business, 21.06.2019 13:30

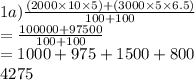

The outstanding bonds of the purple fiddle are priced at $898 and mature in nine years. these bonds have a 6 percent coupon and pay interest annually. the firm's tax rate is 35 percent. what is the firm's after tax cost of debt?

Answers: 3

Business, 21.06.2019 14:20

Xt year baldwin plans to include an additional performance bonus of 0.25% in its compensation plan. this incentive will be provided in addition to the annual raise, if productivity goals are reached. assuming the goals are reached, how much will baldwin pay its employees per hour?

Answers: 2

Business, 21.06.2019 21:30

You invest all the money you earned during your summer sales job (a total of $45,000) into the stock of a company that produces fat and carb-free cheetos. the company stock is expected to earn a 14% annual return; however, 5 years later it is only worth $20,000. turns out there wasn't as much demand for fat and carb-free cheetos as you had hoped. what is the annual rate of return on your investment?

Answers: 1

Business, 22.06.2019 07:30

Jordan, inc. sells fireworks. the company’s marketing director developed the following cost of goods sold budget for april, may, june, and july. april may june july budgeted cost of goods sold $62,000 $72,000 $82,000 $88,000 jordan had a beginning inventory balance of $3,000 on april 1 and a beginning balance in accounts payable of $14,600. the company desires to maintain an ending inventory balance equal to 15 percent of the next period’s cost of goods sold. jordan makes all purchases on account. the company pays 65 percent of accounts payable in the month of purchase and the remaining 35 percent in the month following purchase. required prepare an inventory purchases budget for april, may, and june. determine the amount of ending inventory jordan will report on the end-of-quarter pro forma balance sheet. prepare a schedule of cash payments for inventory for april, may, and june. determine the balance in accounts payable jordan will report on the end-of-quarter pro forma balance sheet.

Answers: 2

You know the right answer?

PLEASE ANSWER ASAP WILL GIVE BRAINLIEST AN LOT OF POINTS

Frugala is pleased when Sylvestor puts $2...

Questions

Mathematics, 30.10.2020 02:20

English, 30.10.2020 02:20

English, 30.10.2020 02:20

History, 30.10.2020 02:20

Chemistry, 30.10.2020 02:20

Mathematics, 30.10.2020 02:20

Mathematics, 30.10.2020 02:20

Mathematics, 30.10.2020 02:20

History, 30.10.2020 02:20