Business, 07.05.2021 09:30 lakenyahar

BRYCE: Has a high paying job and has determined he could afford up to $2700 per month

Wants a sweet home to reward all his hard work; his dream home costs $550,000

Has been sloppy in the past with his bill pay, leading to a credit score of 670, so the best rate he can get is 4.26% for 30 years fixed

Is willing to contribute $75,000 to his down payment

How much, per month, is Bryce short on the mortgage payments for his dream home?

$

How much would Bryce’s down payment need to be if he wanted to get his monthly payments down to $2,500 or slightly under?

Using this strategy, how much total interest would he pay over the course of the loan?

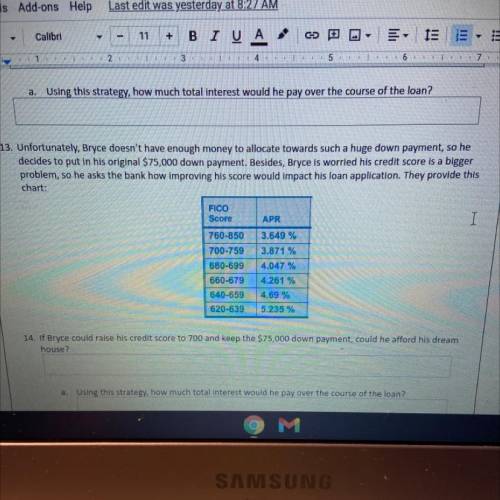

Unfortunately, Bryce doesn’t have enough money to allocate towards such a huge down payment, so he decides to put in his original $75,000 down payment. Besides, Bryce is worried his credit score is a bigger problem, so he asks the bank how improving his score would impact his loan application. They provide this chart:

If Bryce could raise his credit score to 700 and keep the $75,000 down payment, could he afford his dream house? (760-850 = 3.649%, 700-759 = 3.871%, 680-699 = 4.047%, 660-679 = 4.261%, 640-659 = 4.69%, 620-639 = 5.235%)

Using this strategy, how much total interest would he pay over the course of the loan?

What do you think Bryce should do?

Answers: 2

Another question on Business

Business, 21.06.2019 21:30

Which of the following statements is true regarding the definition of a fund? a fund is a fiscal entity which is designed to provide reporting that demonstrates conformance with finance-related legal and contractual provisions separately from gaap reporting. a fund exists to assist in carrying on activities and attaining objectives where there are no specific rules or restrictions. a fund is an accounting entity which is designed to enable reporting in conformity with gaap without being restricted by legal or contractual provisions. a fund is a mechanism developed to provide accounting for revenues and expenditures that are subject to certain restrictions separate from revenues and expenditures that are not subject to restrictions.

Answers: 1

Business, 22.06.2019 01:00

Granby foods' (gf) balance sheet shows a total of $25 million long-term debt with a coupon rate of 8.50%. the yield to maturity on this debt is 8.00%, and the debt has a total current market value of $27 million. the company has 10 million shares of stock, and the stock has a book value per share of $5.00. the current stock price is $20.00 per share, and stockholders' required rate of return, r s, is 12.25%. the company recently decided that its target capital structure should have 35% debt, with the balance being common equity. the tax rate is 40%. calculate waccs based on book, market, and target capital structures. what is the sum of these three waccs?

Answers: 3

Business, 22.06.2019 18:00

Large public water and sewer companies often become monopolies because they benefit from although the company faces high start-up costs, the firm experiences average production costs as it expands and adds more customers. smaller competitors would experience average costs and would be less

Answers: 1

Business, 22.06.2019 19:40

The following cost and inventory data are taken from the accounting records of mason company for the year just completed: costs incurred: direct labor cost $ 90,000 purchases of raw materials $ 134,000 manufacturing overhead $ 205,000 advertising expense $ 45,000 sales salaries $ 101,000 depreciation, office equipment $ 225,000 beginning of the year end of the year inventories: raw materials $ 8,100 $ 10,300 work in process $ 5,900 $ 21,000 finished goods $ 77,000 $ 25,800 required: 1. prepare a schedule of cost of goods manufactured. 2. prepare the cost of goods sold section of mason company’s income statement for the year.

Answers: 3

You know the right answer?

BRYCE: Has a high paying job and has determined he could afford up to $2700 per month

Wants a swee...

Questions

Computers and Technology, 24.08.2021 04:10

Mathematics, 24.08.2021 04:10

Social Studies, 24.08.2021 04:10

Mathematics, 24.08.2021 04:10