Business, 14.05.2021 05:10 rainyshea72

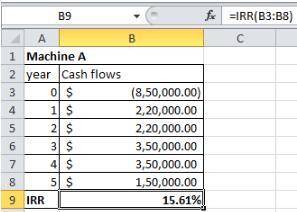

Machine A costs $850,000 and would produce cash flows of $220,000 per year for the first two years, $350,000 per year for the next two years, and $150,000 in the final year. Machine B costs $650,000 and would produce cash flows of $250,000 per year for the first two years, $200,000 the following year, $150,000 in its fourth year, and $140,000 in its final year. Your required return is 11%. What is the IRR of buying machine A?

Answers: 1

Another question on Business

Business, 21.06.2019 22:50

The winston company estimates that the factory overhead for the following year will be $1,250,000. the company has decided that the basis for applying factory overhead should be machine hours, which is estimated to be 50,000 hours. the total machine hours for the year were 54,300. the actual factory overhead for the year were $1,375,000. determine the over- or underapplied amount for the year.

Answers: 1

Business, 22.06.2019 04:00

Last week paul, ceo of quality furniture in south carolina, traveled to europe to visit customers. while overseas, paul checked his e-mail daily and showed his company's website to customers, explaining how the website will them place orders and receive merchandise more quickly. after visiting the last customer friday morning, paul was able to return to the corporate office in south carolina to meet with his board of directors that night. is the "shrinking" of time and space with air travel and electronic media.

Answers: 1

Business, 22.06.2019 07:10

Walsh company manufactures and sells one product. the following information pertains to each of the company’s first two years of operations: variable costs per unit: manufacturing: direct materials $ 25 direct labor $ 12 variable manufacturing overhead $ 5 variable selling and administrative $ 4 fixed costs per year: fixed manufacturing overhead $ 400,000 fixed selling and administrative expenses $ 60,000 during its first year of operations, walsh produced 50,000 units and sold 40,000 units. during its second year of operations, it produced 40,000 units and sold 50,000 units. the selling price of the company’s product is $83 per unit. required: 1. assume the company uses variable costing: a. compute the unit product cost for year 1 and year 2. b. prepare an income statement for year 1 and year 2. 2. assume the company uses absorption costing: a. compute the unit product cost for year 1 and year 2. b. prepare an income statement for year 1 and year 2. 3. reconcile the difference between variable costing and absorption costing net operating income in year 1.

Answers: 3

Business, 22.06.2019 09:30

When you hire an independent contractor you don't have to pay the contractors what

Answers: 3

You know the right answer?

Machine A costs $850,000 and would produce cash flows of $220,000 per year for the first two years,...

Questions

Biology, 08.02.2022 02:40

Mathematics, 08.02.2022 02:40

History, 08.02.2022 02:40

Mathematics, 08.02.2022 02:40

Mathematics, 08.02.2022 02:40

Mathematics, 08.02.2022 02:40

Advanced Placement (AP), 08.02.2022 02:40

Mathematics, 08.02.2022 02:40

Mathematics, 08.02.2022 02:50

Mathematics, 08.02.2022 02:50