Business, 15.05.2021 01:00 GoAheadAndSmileToday

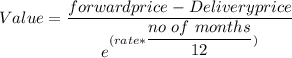

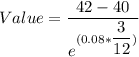

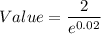

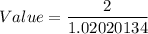

A long position of the three-month forward contract on a commodity that was negotiated three months ago has a delivery price of $40. The current forward price for a three-month forward contract is $42. The current spot price of this commodity is also $42. The three month risk-free interest rate (with continuous compounding) is 8%. What is the value of this long forward contract now

Answers: 3

Another question on Business

Business, 22.06.2019 04:10

What is the difference between secure bonds and naked bonds?

Answers: 1

Business, 22.06.2019 05:50

Which is one solution to levy the complexity of the global matrix strategy with added customer-focused dimensions?

Answers: 3

Business, 22.06.2019 11:00

Zoe would like to be able to save for night courses at the local college. which of these would be a good way for zoe to make more money available for savings without dramatically changing her budget? economía

Answers: 2

Business, 22.06.2019 11:30

12. to produce a textured purée, you would use a/an a. food processor. b. wide-mesh sieve. c. immersion blender d. food mill. student a incorrect which is correct answer?

Answers: 2

You know the right answer?

A long position of the three-month forward contract on a commodity that was negotiated three months...

Questions

Mathematics, 30.01.2021 09:00

Mathematics, 30.01.2021 09:00

Mathematics, 30.01.2021 09:00

Mathematics, 30.01.2021 09:00

Mathematics, 30.01.2021 09:10

Biology, 30.01.2021 09:10

Mathematics, 30.01.2021 09:10

English, 30.01.2021 09:10

Mathematics, 30.01.2021 09:10