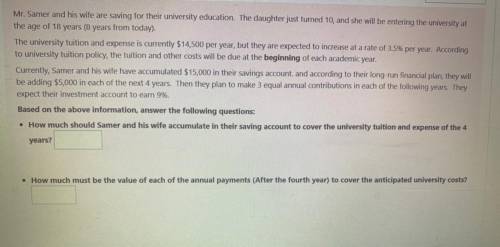

Mr. Samer and his wife are saving for their university education. The daughter just turned 10, and she will be entering the university at

the age of 18 years (8 years from today).

The university tuition and expense is currently $14,500 per year, but they are expected to increase at a rate of 3.5% per year. According

to university tuition policy, the tuition and other costs will be due at the beginning of each academic year.

Currently, Samer and his wife have accumulated $15,000 in their savings account and according to their long-run financial plan, they will

be adding $5,000 in each of the next 4 years. Then they plan to make 3 equal annual contributions in each of the following years. They

expect their investment account to earn 9%.

Based on the above information, answer the following questions:

• How much should Samer and his wife accumulate in their saving account to cover the university tuition and expense of the 4

years?

• How much must be the value of each of the annual payments (After the fourth year) to cover the anticipated university costs?

Answers: 1

Another question on Business

Business, 21.06.2019 16:00

Jodi is trying to save money for a down payment on a house. she invests $6,000 into an account paying 5.5% simple interest. for how long must she save if she needs $7,300 for the down payment? a. 2 years b. 3 years c. 4 years d. 5 years

Answers: 1

Business, 21.06.2019 16:30

Kevin comes across people from various cultures in his job.kevin should deal with people from other cultures with blank . he should communicate by actively

Answers: 3

Business, 22.06.2019 00:50

At a roundabout, you must yield to a. already in the roundaboutb. entering the roundaboutc. only if their turn signal is ond. only if they honk at you

Answers: 1

Business, 22.06.2019 03:00

Which of the following is an effective strategy when interest rates are falling? a. use long-term loans to take advantage of current low rates. b. use short-term loans to take advantage of lower rates when you refinance a loan. c. deposit to a short-term savings instrumentals to take advantage of higher interest rates when they mature. d.select short-term savings instruments to lock in earnings at a current high rates.

Answers: 1

You know the right answer?

Mr. Samer and his wife are saving for their university education. The daughter just turned 10, and s...

Questions

Business, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

Spanish, 18.03.2021 02:40

Biology, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

Biology, 18.03.2021 02:40