Part I

The Scenario:

When the day begins, Mary has $70 in her checking account, and she has...

Business, 20.05.2021 19:50 legendman27

Part I

The Scenario:

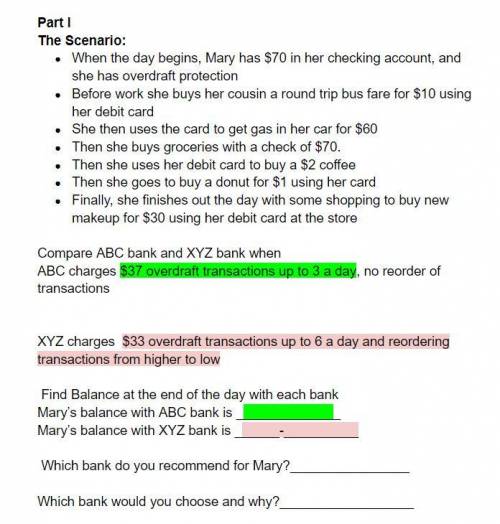

When the day begins, Mary has $70 in her checking account, and she has overdraft protection

Before work she buys her cousin a round trip bus fare for $10 using her debit card

She then uses the card to get gas in her car for $60

Then she buys groceries with a check of $70.

Then she uses her debit card to buy a $2 coffee

Then she goes to buy a donut for $1 using her card

Finally, she finishes out the day with some shopping to buy new makeup for $30 using her debit card at the store

Compare ABC bank and XYZ bank when

ABC charges $37 overdraft transactions up to 3 a day, no reorder of transactions

XYZ charges $33 overdraft transactions up to 6 a day and reordering transactions from higher to low

Find Balance at the end of the day with each bank

Mary’s balance with ABC bank is _

Mary’s balance with XYZ bank is _-_

Which bank do you recommend for Mary?_

Which bank would you choose and why?_

Need answers ASAP please it would be greatly appriciated

Answers: 3

Another question on Business

Business, 22.06.2019 01:00

Cooper, cpa, is auditing the financial statements of a small rural municipality. the receivable balances represent residents’ delinquent real estate taxes. internal control at the municipality is weak. to determine the existence of the accounts receivable balances at the balance sheet date, cooper would most likely: cooper, cpa, is auditing the financial statements of a small rural municipality. the receivable balances represent residents’ delinquent real estate taxes. internal control at the municipality is weak. to determine the existence of the accounts receivable balances at the balance sheet date, cooper would most likely:

Answers: 3

Business, 22.06.2019 04:00

Don’t give me to many notifications because it will cause you to lose alot of points

Answers: 1

Business, 22.06.2019 06:10

Information on gerken power co., is shown below. assume the company’s tax rate is 40 percent. debt: 9,400 8.4 percent coupon bonds outstanding, $1,000 par value, 21 years to maturity, selling for 100.5 percent of par; the bonds make semiannual payments. common stock: 219,000 shares outstanding, selling for $83.90 per share; beta is 1.24. preferred stock: 12,900 shares of 5.95 percent preferred stock outstanding, currently selling for $97.10 per share. market: 7.2 percent market risk premium and 5 percent risk-free rate. required: calculate the company's wacc. (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) wacc %

Answers: 2

Business, 22.06.2019 11:50

Select the correct answer. ramon applied to the state university in the city where he lives, but he was denied admission. what should he do now? a.change his mind about graduating and drop out of high school so he can start working right away. b. decide not to go to college, because he didn’t have a backup plan. c.stay positive and write a mean letter to let the college know that they made a bad decision. d. learn from this opportunity, reevaluate his options, and apply to his second and third choices.

Answers: 2

You know the right answer?

Questions

Mathematics, 13.12.2019 22:31

Chemistry, 13.12.2019 22:31

History, 13.12.2019 22:31

Spanish, 13.12.2019 22:31

Engineering, 13.12.2019 22:31

Social Studies, 13.12.2019 22:31

Biology, 13.12.2019 22:31

Business, 13.12.2019 22:31