Business, 21.05.2021 20:40 elistopchaniuk

CON 3-1 (Algo) Accounting for Operating Activities in a New Business (the Accounting Cycle) LO3-4, 3-5, 3-6

Penny's Pool Service & Supply, Inc. (PPSS) had the following transactions related to operating the business in its first year's busiest quarter ended September 30:

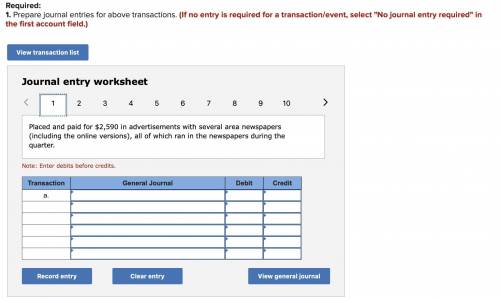

a. Placed and paid for $2,590 in advertisements with several area newspapers (including the online versions), all of which ran in the newspapers during the quarter.

b. Cleaned pools for customers for $18,200, receiving $15,000 in cash with the rest owed by customers who will pay when billed in October.

c. Paid Pool Corporation, Inc., a pool supply wholesaler, $10,500 for inventory received by PPSS in May.

d. As an incentive to maintain customer loyalty, PPSS offered customers a discount for prepaying next year’s pool cleaning service. PPSS received $9,900 from customers who took advantage of the discount.

e. Paid the office receptionist $4,500, with $1,350 owed from work in the prior quarter and the rest from work in the current quarter. Last quarter’s amount was recorded as an expense and a liability, Wages Payable.

f. Had the company van repaired, paying $200 to the mechanic.

g. Paid $200 for phone, water, and electric utilities used during the quarter.

h. Received $130 cash in interest earned during the current quarter on short-term investments.

i. Received a property tax bill for $400 for use of the land and building in the quarter; the bill will be paid next quarter.

j. Paid $1,600 for the next quarter’s insurance coverage.

Required:

1. Prepare journal entries FOR ALL THE ABOVE transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Answers: 2

Another question on Business

Business, 22.06.2019 10:00

You are president of a large corporation. at a typical monthly meeting, each of your vice presidents gives standard area reports. in the past, these reports have been good, and the vps seem satisfied about their work. based on situational approach to leadership, which leadership style should you exhibit at the next meeting?

Answers: 2

Business, 22.06.2019 11:40

In each of the following, what happens to the unemployment rate? does the unemployment rate give an accurate impression of what’s happening in the labor market? a.esther lost her job and begins looking for a new one.b.sam, a steelworker who has been out of work since his mill closed last year, becomes discouraged and gives up looking for work.c.dan, the sole earner in his family of 5, just lost his $90,000 job as a research scientist. immediately, he takes a part-time job at starbucks until he can find another job in his field.

Answers: 2

Business, 22.06.2019 19:00

The starr theater, owned by meg vargo, will begin operations in march. the starr will be unique in that it will show only triple features of sequential theme movies. as of march 1, the ledger of starr showed: cash $3,150, land $22,000, buildings (concession stand, projection room, ticket booth, and screen) $10,000, equipment $10,000, accounts payable $7,300, and owner’s capital $37,850. during the month of march, the following events and transactions occurred.mar. 2 rented the three indiana jones movies to be shown for the first 3 weeks of march. the film rental was $3,600; $1,600 was paid in cash and $2,000 will be paid on march 10.3 ordered the lord of the rings movies to be shown the last 10 days of march. it will cost $200 per night.9 received $4,500 cash from admissions.10 paid balance due on indiana jones movies rental and $2,200 on march 1 accounts payable.11 starr theater contracted with adam ladd to operate the concession stand. ladd is to pay 15% of gross concession receipts, payable monthly, for the rental of the concession stand.12 paid advertising expenses $900.20 received $5,100 cash from customers for admissions.20 received the lord of the rings movies and paid the rental fee of $2,000.31 paid salaries of $2,900.31 received statement from adam ladd showing gross receipts from concessions of $6,000 and the balance due to starr theater of $900 ($6,000 × 15%) for march. ladd paid one-half the balance due and will remit the remainder on april 5.31 received $9,200 cash from customers for admissions.1.) enter the beginning balances in the ledger.2.) journalize the march transactions. starr records admission revenue as service revenue, rental of the concession stand as rent revenue, and film rental expense as rent expense. (credit account titles are automatically indented when the amount is entered. do not indent manually. record journal entries in the order presented in the problem. if no entry is required, select "no entry" for the account titles and enter 0 for the amounts.)3.) post the march journal entries to the ledger. (post entries in the order of journal entries presented in the previous question.)

Answers: 3

Business, 22.06.2019 20:00

Miller mfg. is analyzing a proposed project. the company expects to sell 14,300 units, plus or minus 3 percent. the expected variable cost per unit is $15 and the expected fixed cost is $35,000. the fixed and variable cost estimates are considered accurate within a plus or minus 3 percent range. the depreciation expense is $32,000. the tax rate is 34 percent. the sale price is estimated at $19 a unit, give or take 3 percent. what is the net income under the worst case scenario?

Answers: 2

You know the right answer?

CON 3-1 (Algo) Accounting for Operating Activities in a New Business (the Accounting Cycle) LO3-4, 3...

Questions

History, 19.12.2021 15:40

English, 19.12.2021 15:40

Social Studies, 19.12.2021 15:40

Mathematics, 19.12.2021 15:40

Mathematics, 19.12.2021 15:40

Social Studies, 19.12.2021 15:50

Mathematics, 19.12.2021 15:50