Business, 29.05.2021 02:40 YamiletRdz721

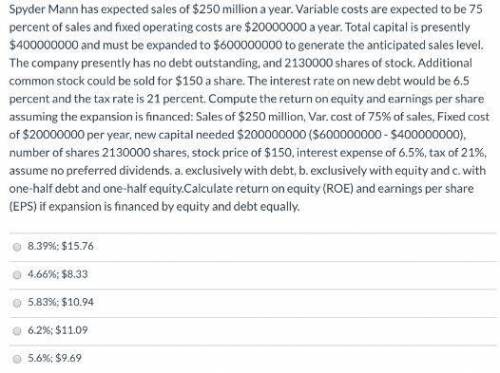

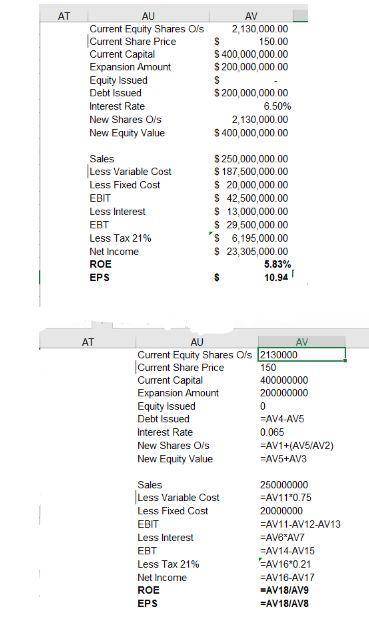

Spyder Mann has expected sales of $250 million a year. Variable costs are expected to be 75 percent of sales and fixed operating costs are $20000000 a year. Total capital is presently $400000000 and must be expanded to $600000000 to generate the anticipated sales level. The company presently has no debt outstanding, and 2130000 shares of stock. Additional common stock could be sold for $150 a share. The interest rate on new debt would be 6.5 percent and the tax rate is 21 percent. Compute the return on equity and earnings per share assuming the expansion is financed: Sales of $250 million, Var. cost of 75% of sales, Fixed cost of $20000000 per year, new capital needed $200000000 ($600000000 - $400000000), number of shares 2130000 shares, stock price of $150, interest expense of 6.5%, tax of 21%, assume no preferred dividends. a. exclusively with debt, b. exclusively with equity and c. with one-half debt and one-half equity. Calculate return on equity (ROE) and earnings per share (EPS) if expansion is financed by debt.

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

Suppose that kenji, an economist from an am talk radio program, and lucia, an economist from a school of industrial relations, are arguing over health insurance. the following dialogue shows an excerpt from their debate: lucia: a popular topic for debate among politicians as well as economists is the idea of providing government assistance for health benefits. kenji: i think it is oppressive for the government to tax people who take care of themselves in order to pay for health insurance for those who are obese. lucia: i disagree. i think government funding of health insurance is useful to ensure basic fairness. the disagreement between these economists is most likely due to . despite their differences, with which proposition are two economists chosen at random most likely to agree? lawyers make up an excessive percentage of elected officials. minimum wage laws do more to harm low-skilled workers than them. tariffs and import quotas generally reduce economic welfare.

Answers: 3

Business, 22.06.2019 11:40

If kroger had whole foods’ number of days’ sales in inventory, how much additional cash flow would have been generated from the smaller inventory relative to its actual average inventory position? round interim calculations to one decimal place and your final answer to the nearest million.

Answers: 2

Business, 22.06.2019 13:10

Laval produces lamps and home lighting fixtures. its most popular product is a brushed aluminum desk lamp. this lamp is made from components shaped in the fabricating department and assembled in the assembly department. information related to the 22,000 desk lamps produced annually follows.direct materials $280,000direct labor fabricating department (8,000 dlh × $24 per dlh) $192,000assembly department (16,600 dlh × $26 per dlh) $431,600machine hours fabricating department $15,200mhassembly department $20,850mhexpected overhead cost and related data for the two production departments follow.fabricating assemblydirect labor hours 150,000dlh 295,000dlhmachine hours 161,000mh 128,000mhoverhead cost $400,000 430,000required1. determine the plantwide overhead rate for laval using direct labor hours as a base.2. determine the total manufacturing cost per unit for the aluminum desk lamp using the plantwide overhead rate.3. compute departmental overhead rates based on machine hours in the fabricating department and direct labor hours in the assembly department.4. use departmental overhead rates from requirement 3 to determine the total manufacturing cost per unit for the aluminum desk lamps.

Answers: 3

Business, 22.06.2019 23:00

Ernesto baca is employed by bigg company. he has a family membership in his company's health insurance program. the annual premium is $5,432. ernesto's employer pays 80% of the total cost. ernesto's contribution is deducted from his paycheck. what is his annual contribution? $1,086.40 $1,125.65 $1,527.98 $1,567.20 save and exit

Answers: 3

You know the right answer?

Spyder Mann has expected sales of $250 million a year. Variable costs are expected to be 75 percent...

Questions

Mathematics, 31.08.2019 23:30

Health, 31.08.2019 23:30

Mathematics, 31.08.2019 23:30

History, 31.08.2019 23:30

Social Studies, 31.08.2019 23:30

Mathematics, 31.08.2019 23:30

Mathematics, 31.08.2019 23:30

Mathematics, 31.08.2019 23:30

Biology, 31.08.2019 23:30

World Languages, 31.08.2019 23:30