Business, 08.06.2021 23:50 dbuchlerdb5599

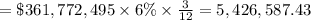

Auerbach Inc. issued 4% bonds on October 1, 2021. The bonds have a maturity date of September 30, 2031 and a face value of $425 million. The bonds pay interest each March 31 and September 30, beginning March 31, 2022. The effective interest rate established by the market was 6%. Assuming that Auerbach issued the bonds for $361,772,495, what interest expense would it recognize in its 2021 income statement

Answers: 1

Another question on Business

Business, 21.06.2019 21:30

Problem 2-18 job-order costing for a service company [lo2-1, lo2-2, lo2-3]speedy auto repairs uses a job-order costing system. the company's direct materials consist of replacement parts installed in customer vehicles, and its direct labor consists of the mechanics' hourly wages. speedy's overhead costs include various items, such as the shop manager's salary, depreciation of equipment, utilities, insurance, and magazine subscriptions and refreshments for the waiting room. the company applies all of its overhead costs to jobs based on direct labor-hours. at the beginning of the year, it made the following estimates: direct labor-hours required to support estimated output 10,000fixed overhead cost $ 90,000variable overhead cost per direct labor-hour $ 1.00 required: 1. compute the predetermined overhead rate.2. during the year, mr. wilkes brought in his vehicle to replace his brakes, spark plugs, and tires. the following information was available with respect to his job: direct materials $ 600direct labor cost $ 180direct labor-hours used 2 compute mr. wilkes' total job cost. 3. if speedy establishes its selling prices using a markup percentage of 30% of its total job cost, then how much would it have charged mr. wilkes?

Answers: 1

Business, 22.06.2019 00:00

Ok, so, theoretical question: if i bought the mona lisa legally, would anyone be able to stop me from eating it? why or why not?

Answers: 1

Business, 22.06.2019 15:20

Capital financial corporation will lend 90 percent against account balances that have averaged 30 days or less; 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. the current prime rate is 16.50 percent, and capital charges 3.50 percent over prime to charming as its annual loan rate. a. determine the maximum loan for which charming paper company could qualify.

Answers: 1

Business, 23.06.2019 06:00

What are some questions to ask a clerk in the dispatch office?

Answers: 1

You know the right answer?

Auerbach Inc. issued 4% bonds on October 1, 2021. The bonds have a maturity date of September 30, 20...

Questions

History, 29.06.2021 08:40

English, 29.06.2021 08:40

Chemistry, 29.06.2021 08:50

Computers and Technology, 29.06.2021 08:50

Mathematics, 29.06.2021 08:50

Physics, 29.06.2021 08:50

Mathematics, 29.06.2021 08:50

Social Studies, 29.06.2021 08:50

Mathematics, 29.06.2021 08:50

Mathematics, 29.06.2021 08:50

Computers and Technology, 29.06.2021 08:50

Social Studies, 29.06.2021 08:50

Mathematics, 29.06.2021 08:50

Computers and Technology, 29.06.2021 08:50

Mathematics, 29.06.2021 08:50

".

".