Julio is in the 32% tax bracket. He acquired 9,000 shares of stock in Gray Corporation seven years ago at a cost of $20 per share. In the current year, Julio received a payment of $135,000 from Gray Corporation in exchange for 4,500 of his shares in Gray. Gray has E & P of $1,000,000. What income tax liabil-ity would Julio incur on the $150,000 payment in each of the following situations? Assume that Julio has no capital losses.

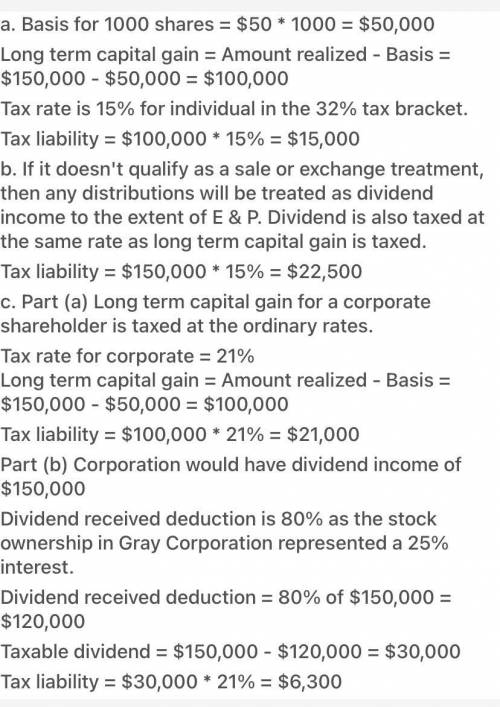

a. The stock redemption qualifies for sale or exchange treatment.

b. The stock redemption does not qualify for sale or exchange treatment.

c. How would your answer to parts (a) and (b) of Problem 49 differ if Julio were a corporate shareholder rather than an individual shareholder and the stock ownership in Gray Corporation represented a 25% interest?

Answers: 1

Another question on Business

Business, 21.06.2019 22:30

True or false: banks are required to make electronically deposited funds available on the same day of the deposit

Answers: 2

Business, 22.06.2019 08:30

What is the equity method balance in the investment in lindman account at the end of 2018?

Answers: 2

Business, 22.06.2019 23:50

Jaguar has full manufacturing costs of their s-type sedan of £22,803. they sell the s-type in the uk with a 20% margin for a price of £27,363. today these cars are available in the us for $55,000 which is the uk price multiplied by the current exchange rate of $2.01/£. jaguar has committed to keeping the us price at $55,000 for the next six months. if the uk pound appreciates against the usd to an exchange rate of $2.15/£, and jaguar has not hedged against currency changes, what is the amount the company will receive in pounds at the new exchange rate?

Answers: 1

Business, 23.06.2019 11:20

In march 2012, the state of california started requiring that all packaging for food and drink with the additive 4-methylimidazole (4-mi) be clearly labeled with a cancer warning. because of this, both pepsi and coke changed their formula to eliminate 4-mi as an ingredient. if pepsi and coke did not change their formula, holding all else constant, what would have happened to the demand for these goods, assuming pepsi and coke were in a competitive market? a. the demand curve for both pepsi and coke would have shifted to the right, causing the price of both products to decrease and the profits for the companies to fall. b. the demand curve for pepsi and coke would have remained unchanged, but the price of both products would have decreased and the profits for the companies would have fallen. c. the demand curve for pepsi and coke would have decreased, but the prices and profits would not have changed. d. the demand curve for only one of them would change because pepsi and coke are substitutes. e. the demand curve for pepsi and coke would have shifted to the left, causing the price of both products to decrease and the profits for both companies to fall.

Answers: 3

You know the right answer?

Julio is in the 32% tax bracket. He acquired 9,000 shares of stock in Gray Corporation seven years a...

Questions

Mathematics, 28.10.2020 22:20

Mathematics, 28.10.2020 22:20

Mathematics, 28.10.2020 22:20

Arts, 28.10.2020 22:20

English, 28.10.2020 22:20

Mathematics, 28.10.2020 22:20

History, 28.10.2020 22:20

History, 28.10.2020 22:20

Geography, 28.10.2020 22:20

Mathematics, 28.10.2020 22:20

Social Studies, 28.10.2020 22:20

Mathematics, 28.10.2020 22:20