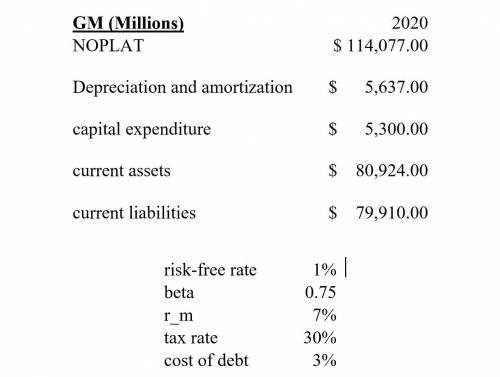

The table above summarizes financial information of General Motors for fiscal year 2020. Its total assets is $235,194 million, and its total liabilities is $185,517 million. Suppose General Motors decides to start another electronic car production line. To implement this decision, GM will increase capital expenditure by 10% each year for the next three years. To finance the increase in capital expenditure, GM will draw its credit lines which increases its current liabilities by 12% each year for the next three years. This new production lines will also require GM to expand its current assets by 15% each year for the next three years. Moreover, GM expects the depreciation and amortization increase by 5% for the next three years. The new production line will increase the net operating profit after tax by 2% for the first three years, and free cash flow after the 3rd grows at 1% permanently thereafter. GM has 1,433 million shares outstanding. What is the fundamental value of GM’s common stock?

Answers: 3

Another question on Business

Business, 21.06.2019 15:30

Kayla and jada are roommates in new york city. both kayla and jada recently received pay raises. kayla now buys more movie tickets than before, but jada buys fewer. kayla behaves as if movie tickets are goods and jada's income elasticity of demand for movie tickets is

Answers: 2

Business, 21.06.2019 19:30

The framers of the us constitution created a system of government that established branches of government set forth the powers of such a branches and placed limits on those powers what are the benefits of such a system? are there any problems associated with such a system?

Answers: 3

Business, 21.06.2019 22:40

The vaska company buys a patent on january 1, year one, and agrees to pay $100,000 per year for the next five years. the first payment is made immediately, and the payments are made on each january 1 thereafter. if a reasonable annual interest rate is 8 percent, what is the recorded value of the patent? 1. $378,4252. $431,2133. $468,9504. $500,000

Answers: 3

Business, 22.06.2019 12:30

True or false entrepreneurs try to meet the needs of the marketplace by supplying a service or product

Answers: 1

You know the right answer?

The table above summarizes financial information of General Motors for fiscal year 2020. Its total a...

Questions

Mathematics, 25.02.2020 00:34

Mathematics, 25.02.2020 00:34

History, 25.02.2020 00:34

Computers and Technology, 25.02.2020 00:34