Use the information for Geiberger Corporation from BE21.12, except assume the collectibility of the rentals is not probable. Prepare any journal entries for Geiberger on December 31, 2019.

In BE21.12

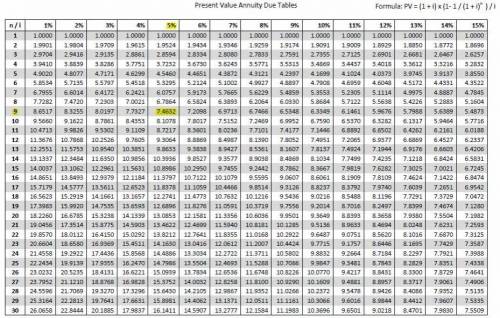

Geiberger Corporation manufactures drones. On December 31, 2019, it leased to Althaus Company a drone that had cost $120,000 to manufacture. The lease agreement covers the 5-year useful life of the drone and requires five equal annual rentals of $40,800 payable each December 31, beginning December 31, 2019. An interest rate of 8% is implicit in the lease agreement. Collectibility of the rentals is probable. Prepare Geiberger’s December 31, 2019, journal entries.

Answers: 2

Another question on Business

Business, 22.06.2019 15:20

Kelso electric is debating between a leveraged and an unleveraged capital structure. the all equity capital structure would consist of 40,000 shares of stock. the debt and equity option would consist of 25,000 shares of stock plus $280,000 of debt with an interest rate of 7 percent. what is the break-even level of earnings before interest and taxes between these two options?

Answers: 2

Business, 22.06.2019 18:00

Carlton industries is considering a new project that they plan to price at $74.00 per unit. the variable costs are estimated at $39.22 per unit and total fixed costs are estimated at $12,085. the initial investment required is $8,000 and the project has an estimated life of 4 years. the firm requires a return of 8 percent. ignore the effect of taxes. what is the degree of operating leverage at the financial break-even level of output?

Answers: 3

Business, 22.06.2019 19:00

In 1975, mcdonald’s introduced its egg mcmuffin breakfast sandwich, which remains popular and profitable today. this longevity illustrates the idea of:

Answers: 1

Business, 22.06.2019 20:10

Your sister is thinking about starting a new business. the company would require $375,000 of assets, and it would be financed entirely with common stock. she will go forward only if she thinks the firm can provide a 13.5% return on the invested capital, which means that the firm must have an roe of 13.5%. how much net income must be expected to warrant starting the business? a. $41,234b. $43,405c. $45,689d. $48,094e. $50,625

Answers: 3

You know the right answer?

Use the information for Geiberger Corporation from BE21.12, except assume the collectibility of the...

Questions

Mathematics, 30.03.2020 17:23

Computers and Technology, 30.03.2020 17:23

English, 30.03.2020 17:23

Biology, 30.03.2020 17:23

Mathematics, 30.03.2020 17:23

Mathematics, 30.03.2020 17:23

Mathematics, 30.03.2020 17:23

Computers and Technology, 30.03.2020 17:23

Arts, 30.03.2020 17:23

Mathematics, 30.03.2020 17:24