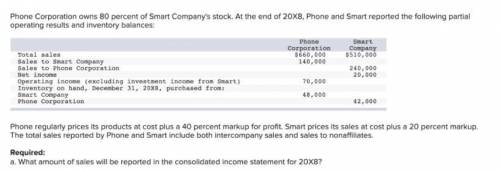

Phone regularly prices its products at cost plus a 40 percent markup for profit. Smart prices its sales at cost plus a 20 percent markup. The total sales reported by Phone and Smart include both intercompany sales and sales to nonaffiliates. Required: a. What amount of sales will be reported in the consolidated income statement for 20X8

Answers: 2

Another question on Business

Business, 21.06.2019 20:20

If the demand for a pair of shoes is given by 2p + 5q = 200 and the supply function for it is p − 2q = 10, compare the quantity demanded and the quantity supplied when the price is $90. quantity demanded pairs of shoes quantity supplied pairs of shoes will there be a surplus or shortfall at this price? there will be a surplus. there will be a shortfall.

Answers: 3

Business, 21.06.2019 20:30

Which of the following statements is correct? a) one drawback of forming a corporation is that it generally subjects the firm to additional regulationsb) one drawback of forming a corporation is that it subjects the firms investors to increased personal liabilitiesc) one drawback of forming a corporation is that it makes it more difficult for the firm to raise capitald) one advantage of forming a corporation is that it subjects the firm's investors to fewer taxese) one disadvantage of forming a corporation is that it is more difficult for the firm's investors to transfer their ownership interests

Answers: 1

Business, 22.06.2019 00:40

The silverside company is considering investing in two alternative projects: project 1 project 2 investment $500,000 $240,000 useful life (years) 8 7 estimated annual net cash inflows for useful life $120,000 $40,000 residual value $32,000 $10,000 depreciation method straightminusline straightminusline required rate of return 11% 8% what is the accounting rate of return for project 2? (round any intermediary calculations to the nearest dollar, and round your final answer to the nearest hundredth of a percent, x.xx%.)

Answers: 3

Business, 22.06.2019 08:30

Match the given situations to the type of risks that a business may face while taking credit. 1. beta ltd. had taken a loan from a bank for a period of 15 years, but its sales are gradually showing a decline. 2. alpha ltd. has taken a loan for increasing its production and sales, but it has not conducted any research before making this decision. 3. delphi ltd. has an overseas client. the economy of the client’s country is going through severe recession. 4. delphi ltd. has taken a short-term loan from the bank, but its supply chain logistics are not in place. a. foreign exchange risk b. operational risk c. term of loan risk d. revenue projections risk

Answers: 3

You know the right answer?

Phone regularly prices its products at cost plus a 40 percent markup for profit. Smart prices its sa...

Questions

Mathematics, 04.05.2021 07:00

Advanced Placement (AP), 04.05.2021 07:00

Mathematics, 04.05.2021 07:00

Mathematics, 04.05.2021 07:00

Mathematics, 04.05.2021 07:00

Physics, 04.05.2021 07:00

Mathematics, 04.05.2021 07:00

Arts, 04.05.2021 07:00

Mathematics, 04.05.2021 07:00