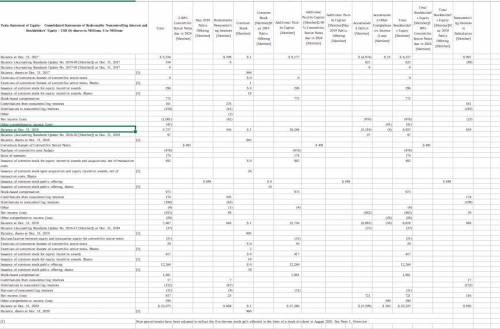

Compare and evaluate Tesla financial statements based on the below points.

Size

o total...

Business, 07.07.2021 08:10 aiken11192006

Compare and evaluate Tesla financial statements based on the below points.

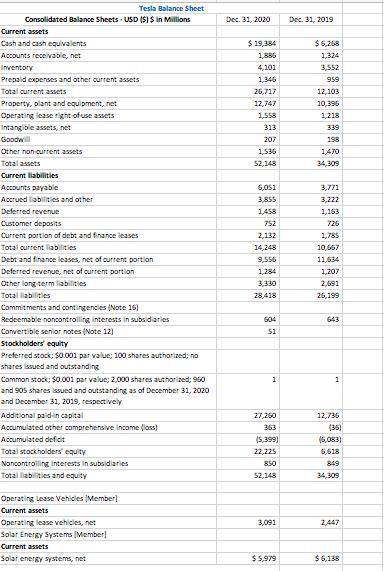

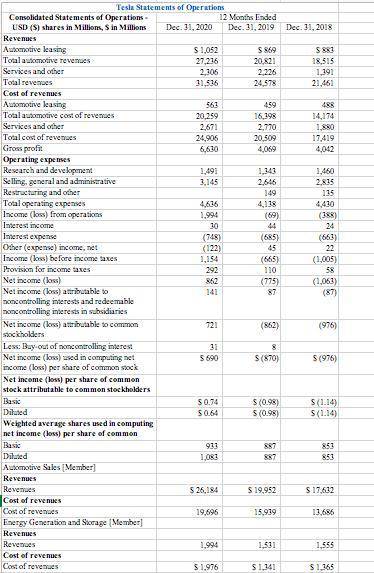

Size

o total assets and total revenue

o market cap

Growth

o asset growth and revenue growth

o market to book ratio

o price to earnings ratio (P/E ratio)

Use following ratios or financial statemen item to compare and analyze business performance.

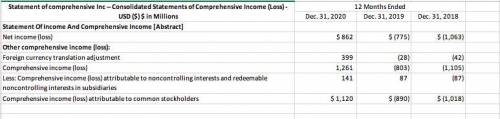

Profitability

o gross profit percentage (LO 5.6)

o return on assets (LO 1.6)

o return on common stockholders’ equity, earnings per share, and the price/earnings ratio (LO 13.7)

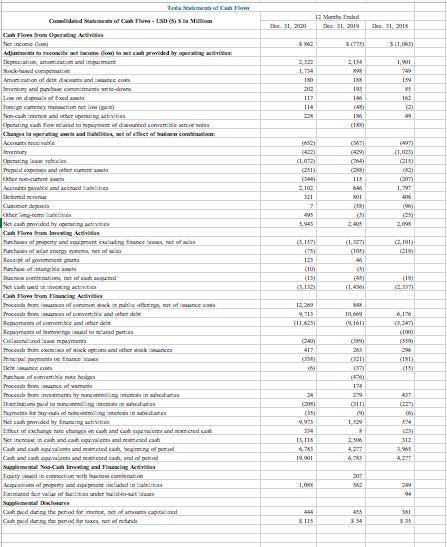

Solvency

o debt ratio (LO 2.5)

o debt to equity (12.6)

o free cash flows

Liquidity

o current ratio (LO 4.6)

o acid-test ratio (LO 8.5)

Operating Efficiency

o inventory turnover, days’ sales in inventory (LO 6.6)

o accounts receivable turnover ratio, and days’ sales in receivables (LO 8.5)

o asset turnover ratio (LO 9.6)

Answers: 3

Another question on Business

Business, 22.06.2019 01:30

Standardization is associated with which of the following management orientations? a) ethnocentric orientation b) polycentric orientation c) regiocentric orientation d) geocentric orientation

Answers: 1

Business, 22.06.2019 06:30

If the findings and the results are not presented properly, the research completed was a waste of time and money. true false

Answers: 1

Business, 22.06.2019 06:40

Burke enterprises is considering a machine costing $30 billion that will result in initial after-tax cash savings of $3.7 billion at the end of the first year, and these savings will grow at a rate of 2 percent per year for 11 years. after 11 years, the company can sell the parts for $5 billion. burke has a target debt/equity ratio of 1.2, a beta of 1.79. you estimate that the return on the market is 7.5% and t-bills are currently yielding 2.5%. burke has two issuances of bonds outstanding. the first has 200,000 bonds trading at 98% of par, with coupons of 5%, face of $1000, and maturity of 5 years. the second has 500,000 bonds trading at par, with coupons of 7.5%, face of $1000, and maturity of 12 years. kate, the ceo, usually applies an adjustment factor to the discount rate of +2 for such highly innovative projects. should the company take on the project?

Answers: 1

Business, 22.06.2019 07:30

1 2 3 4 5 6 7 8 9 10time remaining59: 30in the dark game, how does the author develop the central idea that elizabeth van lew was a spymaster during the civil war? 1 2 3 4 5 6 7 8 9 10time remaining59: 30in the dark game, how does the author develop the central idea that elizabeth van lew was a spymaster during the civil war?

Answers: 1

You know the right answer?

Questions

Arts, 05.12.2020 21:30

Chemistry, 05.12.2020 21:30

English, 05.12.2020 21:30

Biology, 05.12.2020 21:30

Spanish, 05.12.2020 21:30

Mathematics, 05.12.2020 21:30

Biology, 05.12.2020 21:30

Biology, 05.12.2020 21:30

English, 05.12.2020 21:30

Computers and Technology, 05.12.2020 21:30

Mathematics, 05.12.2020 21:30