58.8

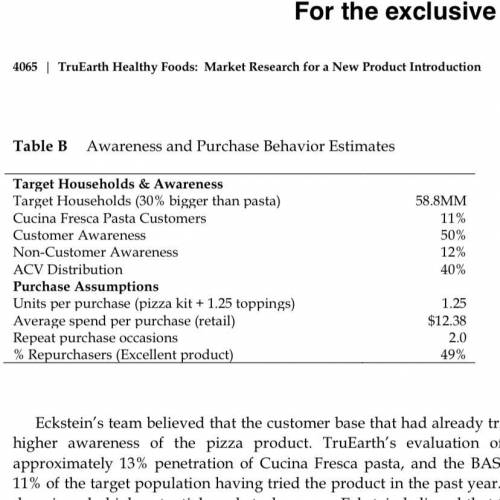

Step 1: Determine the size of the target market, adjusted for awareness and ACV

Target h...

58.8

Step 1: Determine the size of the target market, adjusted for awareness and ACV

Target households (MM)

Penetration, % of target households

13%

Target by type (pasta customers, non customers)

0.1

100%

0.1

50%

12%

Awareness of pizza product

Target households, adjusted for awareness

40%

40%

ACV distribution

Target market, adjusted for awareness and ACV

Answers: 2

Another question on Business

Business, 21.06.2019 21:30

Which of the following statements is true regarding the definition of a fund? a fund is a fiscal entity which is designed to provide reporting that demonstrates conformance with finance-related legal and contractual provisions separately from gaap reporting. a fund exists to assist in carrying on activities and attaining objectives where there are no specific rules or restrictions. a fund is an accounting entity which is designed to enable reporting in conformity with gaap without being restricted by legal or contractual provisions. a fund is a mechanism developed to provide accounting for revenues and expenditures that are subject to certain restrictions separate from revenues and expenditures that are not subject to restrictions.

Answers: 1

Business, 22.06.2019 08:10

What are the period and vertical shift of the cosecant function below? period: ; vertical shift: 1 unit up period: ; vertical shift: 2 units up period: ; vertical shift: 1 unit up period: ; vertical shift: 2 units up?

Answers: 3

Business, 22.06.2019 11:50

Stocks a, b, and c are similar in some respects: each has an expected return of 10% and a standard deviation of 25%. stocks a and b have returns that are independent of one another; i.e., their correlation coefficient, r, equals zero. stocks a and c have returns that are negatively correlated with one another; i.e., r is less than 0. portfolio ab is a portfolio with half of its money invested in stock a and half in stock b. portfolio ac is a portfolio with half of its money invested in stock a and half invested in stock c. which of the following statements is correct? a. portfolio ab has a standard deviation that is greater than 25%.b. portfolio ac has an expected return that is less than 10%.c. portfolio ac has a standard deviation that is less than 25%.d. portfolio ab has a standard deviation that is equal to 25%.e. portfolio ac has an expected return that is greater than 25%.

Answers: 3

Business, 22.06.2019 17:10

Storico co. just paid a dividend of $3.15 per share. the company will increase its dividend by 20 percent next year and then reduce its dividend growth rate by 5 percentage points per year until it reaches the industry average of 5 percent dividend growth, after which the company will keep a constant growth rate forever. if the required return on the company’s stock is 12 percent, what will a share of stock sell for today?

Answers: 1

You know the right answer?

Questions

Mathematics, 28.07.2019 04:33

Mathematics, 28.07.2019 04:33

Mathematics, 28.07.2019 04:33

History, 28.07.2019 04:33

Mathematics, 28.07.2019 04:33

History, 28.07.2019 04:33

Biology, 28.07.2019 04:33

Biology, 28.07.2019 04:33

Chemistry, 28.07.2019 04:33

Physics, 28.07.2019 04:33