Pastina Company sells various types of pasta to grocery chains as private label brands. The company's reporting year-end is December 31. The unadjusted trial balance as of December 31, 2021, appears below.

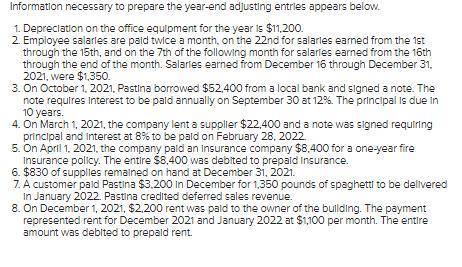

Information necessary to prepare the year-end adjusting entries appears below.

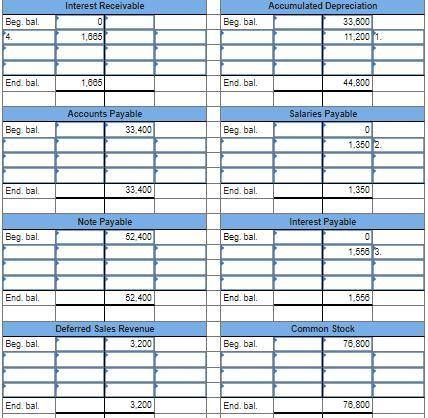

Depreciation on the office equipment for the year is $11,200.

Employee salaries are paid twice a month, on the 22nd for salaries earned from the 1st through the 15th, and on the 7th of the following month for salaries earned from the 16th through the end of the month. Salaries earned from December 16 through December 31, 2021, were $1,350.

On October 1, 2021, Pastina borrowed $52,400 from a local bank and signed a note. The note requires interest to be paid annually on September 30 at 12%. The principal is due in 10 years.

On March 1, 2021, the company lent a supplier $22,400 and a note was signed requiring principal and interest at 8% to be paid on February 28, 2022.

On April 1, 2021, the company paid an insurance company $8,400 for a one-year fire insurance policy. The entire $8,400 was debited to prepaid insurance.

$830 of supplies remained on hand at December 31, 2021.

A customer paid Pastina $3,200 in December for 1,350 pounds of spaghetti to be delivered in January 2022. Pastina credited deferred sales revenue.

On December 1, 2021, $2,200 rent was paid to the owner of the building. The payment represented rent for December 2021 and January 2022 at $1,100 per month. The entire amount was debited to prepaid rent.

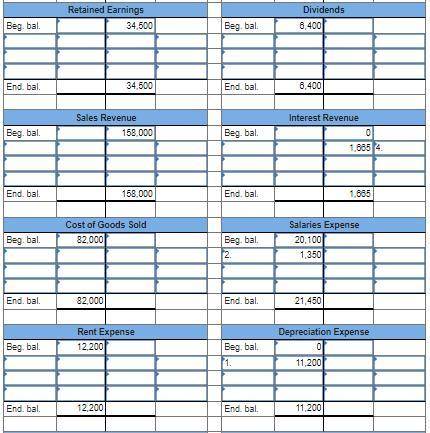

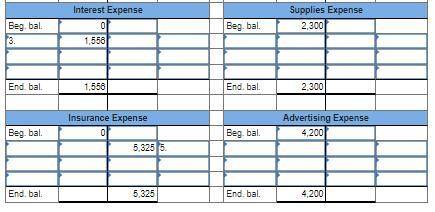

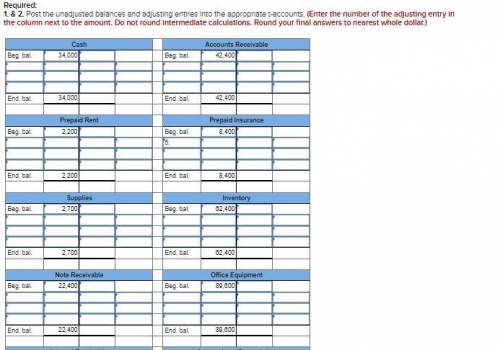

1. & 2. Post the unadjusted balances and adjusting entires into the appropriate t-accounts. (Enter the number of the adjusting entry in the column next to the amount. Do not round intermediate calculations. Round your final answers to nearest whole dollar.)

Answers: 3

Another question on Business

Business, 22.06.2019 13:00

Creation landscaping has 1,000 bonds outstanding that are selling for $1,280 each. the company also has 2,000 shares of preferred stock outstanding, currently priced at $27.20 a share. the common stock is priced at $37.00 a share and there are 28,000 shares outstanding. what is the weight of the debt as it relates to the firm's weighted average cost of capital?

Answers: 1

Business, 22.06.2019 19:40

The following cost and inventory data are taken from the accounting records of mason company for the year just completed: costs incurred: direct labor cost $ 90,000 purchases of raw materials $ 134,000 manufacturing overhead $ 205,000 advertising expense $ 45,000 sales salaries $ 101,000 depreciation, office equipment $ 225,000 beginning of the year end of the year inventories: raw materials $ 8,100 $ 10,300 work in process $ 5,900 $ 21,000 finished goods $ 77,000 $ 25,800 required: 1. prepare a schedule of cost of goods manufactured. 2. prepare the cost of goods sold section of mason company’s income statement for the year.

Answers: 3

Business, 22.06.2019 21:10

You are the manager of a large crude-oil refinery. as part of the refining process, a certain heat exchanger (operated at high temperatures and with abrasive material flowing through it) must be replaced every year. the replacement and downtime cost in the first year is $165 comma 000. this cost is expected to increase due to inflation at a rate of 7% per year for six years (i.e. until the eoy 7), at which time this particular heat exchanger will no longer be needed. if the company's cost of capital is 15% per year, how much could you afford to spend for a higher quality heat exchanger so that these annual replacement and downtime costs could be eliminated?

Answers: 1

Business, 22.06.2019 23:10

The direct labor budget of yuvwell corporation for the upcoming fiscal year contains the following details concerning budgeted direct labor-hours: 1st quarter 2nd quarter 3rd quarter 4th quarterbudgeted direct labor-hours 11,200 9,800 10,100 10,900the company uses direct labor-hours as its overhead allocation base. the variable portion of its predetermined manufacturing overhead rate is $6.00 per direct labor-hour and its total fixed manufacturing overhead is $80,000 per quarter. the only noncash item included in fixed manufacturing overhead is depreciation, which is $20,000 per quarter.required: 1. prepare the company’s manufacturing overhead budget for the upcoming fiscal year.2. compute the company’s predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year.

Answers: 3

You know the right answer?

Pastina Company sells various types of pasta to grocery chains as private label brands. The company'...

Questions

Mathematics, 13.10.2019 00:10

Mathematics, 13.10.2019 00:10

History, 13.10.2019 00:10

Mathematics, 13.10.2019 00:10