Business, 12.09.2021 07:50 kittycat92

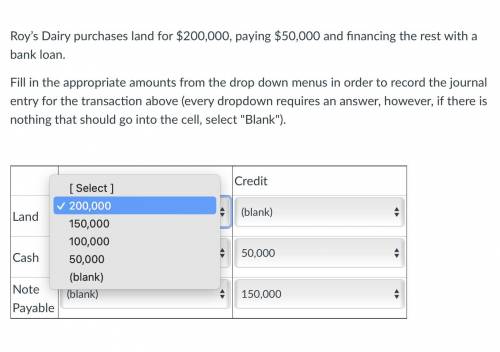

Roy’s Dairy purchases land for $200,000, paying $50,000 and financing the rest with a bank loan. Fill in the appropriate amounts from the drop down menus in order to record the journal entry for the transaction above (every dropdown requires an answer, however, if there is nothing that should go into the cell, select "Blank").

Answers: 3

Another question on Business

Business, 21.06.2019 16:30

Eager, a tipped employee, reported to his employer that he had received $320 in tips during march. on the next payday, april 4, he was paid his regular salary of $250. the amount of oasdi taxes to withhold from eager’s pay is a. $19.84 b. $15.50 c. $35.34 d. $43.61 e. none of the above. 2 points

Answers: 1

Business, 22.06.2019 09:30

Factors like the unemployment rate, the stock market, global trade, economic policy, and the economic situation of other countries have no influence on the financial status of individuals. question 1 options: true false

Answers: 1

Business, 22.06.2019 12:00

Simon, aged 10, is invited to a classmate's birthday party at an exclusive ski resort on march 15th. the day will include 4 hours of snowboarding, lunch and birthday cake. simon's mother checks a box on the invitation that says "yes, we will attend" and returns it to the classmate's address. unfortunately, they later don't attend the party when simon comes down with the flu. on march 17th, simon's mother receives an invoice in the mail from simon's classmate for $35 that says, "party no-show fee." can simon's classmate collect the fee?

Answers: 3

Business, 22.06.2019 21:00

Which of the following statements is correct? stockholders should generally be happier than bondholders to have managers invest in risky projects with high potential returns as opposed to safe projects with lower expected returns. potential conflicts between stockholders and bondholders are increased if a firm's bonds are convertible into its common stock. takeovers are most likely to be attempted if the target firm’s stock price is above its intrinsic value. one advantage of operating a business as a corporation is that stockholders can deduct their pro rata share of the taxes the firm pays, thereby eliminating the double taxation investors would face in a partnership.

Answers: 1

You know the right answer?

Roy’s Dairy purchases land for $200,000, paying $50,000 and financing the rest with a bank loan.

F...

Questions

Biology, 22.03.2021 18:20

Mathematics, 22.03.2021 18:20

History, 22.03.2021 18:20

English, 22.03.2021 18:20

Mathematics, 22.03.2021 18:20

Engineering, 22.03.2021 18:20

Mathematics, 22.03.2021 18:20

Mathematics, 22.03.2021 18:20