Business, 06.10.2021 08:20 sarbjit879

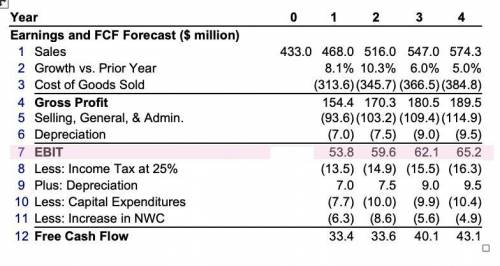

Sora Industries has 60 million outstanding shares, $120 million in debt, $40

a. Suppose Sora's revenue and free cash flow are expected to grow at a

5.0% rate beyond year four. If Sora's weighted average cost of capital is

10.0%, what is the value of Sora stock based on this information?

b. Sora's cost of goods sold was assumed to be 67% of sales. If its cost of goods sold is actually 70% of sales, how would the estimate of the stock's value change?

c. Return to the assumptions of part (a) and suppose Sora can maintain its cost of goods sold at 67% of sales. However, the firm reduces its selling, general, and administrative expenses from 20% of sales to 16% of sales. What stock price would you estimate now? (Assume no other expenses, except taxes, are affected.)

d. Sora's net working capital needs were estimated to be 18% of sales (their current level in year zero). If Sora can reduce this requirement to 12% of sales starting in year 1, but all other assumptions are as in (a), what stock price do you estimate for Sora? (Hint: This change will have the largest impact on Sora's free cash flow in year 1.)

Answers: 1

Another question on Business

Business, 22.06.2019 15:20

Kelso electric is debating between a leveraged and an unleveraged capital structure. the all equity capital structure would consist of 40,000 shares of stock. the debt and equity option would consist of 25,000 shares of stock plus $280,000 of debt with an interest rate of 7 percent. what is the break-even level of earnings before interest and taxes between these two options?

Answers: 2

Business, 22.06.2019 19:20

After jeff bezos read about how the internet was growing by 2,000 percent a month, he set out to use the internet as a new distribution channel and founded amazon, which is now the world's largest online retailer. this is clearly an example of a(n)a. firm that uses closed innovation. b. entrepreneur who commercialized invention into an innovation. c. business that entered the industry during its maturity stage. d. exception to the long tail business model

Answers: 1

Business, 22.06.2019 20:30

The research of robert siegler and eric jenkins on the development of the counting-on strategy is an example of design.

Answers: 3

You know the right answer?

Sora Industries has 60 million outstanding shares, $120 million in debt, $40

a. Suppose Sora's rev...

Questions

History, 18.09.2019 06:00

Mathematics, 18.09.2019 06:00

Chemistry, 18.09.2019 06:00

History, 18.09.2019 06:00

Physics, 18.09.2019 06:00

Business, 18.09.2019 06:00

Mathematics, 18.09.2019 06:00

Spanish, 18.09.2019 06:00

Social Studies, 18.09.2019 06:00

Mathematics, 18.09.2019 06:00

Mathematics, 18.09.2019 06:00

History, 18.09.2019 06:00

Mathematics, 18.09.2019 06:00