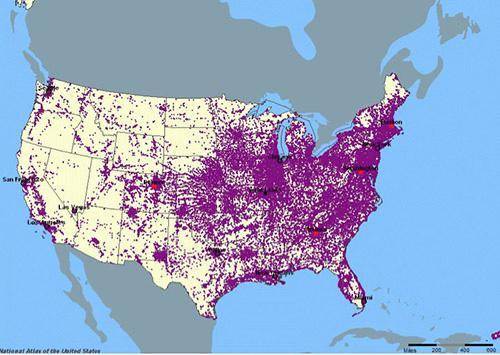

Map shows a concentration, in purple dots, of air release, or emissions, sites across the United States. Major cities, including Los Angeles, New York, and Chicago, are labeled. Heavy concentrations of dots appear around urban centers, and the eastern half of the country appears largely in dots with little uncolored space. The western half shows a sparser distribution of dot air emissions sites, mostly centered around cities. A large amount of space with no dots appears on the western half of the map.

© 2013 United States Department of the Interior

The map above shows air release, or emissions, sites across the United States. These sites include locations such as smokestacks, factories, and high vehicle traffic areas. The data in the map most directly relate to potential negative and positive externalities affecting

commons

incentives

free riders

free resources

Answers: 1

Another question on Business

Business, 22.06.2019 10:10

An investment offers a total return of 18 percent over the coming year. janice yellen thinks the total real return on this investment will be only 14 percent. what does janice believe the inflation rate will be over the next year?

Answers: 3

Business, 22.06.2019 12:10

Profits from using currency options and futures.on july 2, the two-month futures rate of the mexican peso contained a 2 percent discount (unannualized). there was a call option on pesos with an exercise price that was equal to the spot rate. there was also a put option on pesos with an exercise price equal to the spot rate. the premium on each of these options was 3 percent of the spot rate at that time. on september 2, the option expired. go to the oanda.com website (or any site that has foreign exchange rate quotations) and determine the direct quote of the mexican peso. you exercised the option on this date if it was feasible to do so. a. what was your net profit per unit if you had purchased the call option? b. what was your net profit per unit if you had purchased the put option? c. what was your net profit per unit if you had purchased a futures contract on july 2 that had a settlement date of september 2? d. what was your net profit per unit if you sold a futures contract on july 2 that had a settlement date of september 2

Answers: 1

Business, 22.06.2019 17:10

Storico co. just paid a dividend of $3.15 per share. the company will increase its dividend by 20 percent next year and then reduce its dividend growth rate by 5 percentage points per year until it reaches the industry average of 5 percent dividend growth, after which the company will keep a constant growth rate forever. if the required return on the company’s stock is 12 percent, what will a share of stock sell for today?

Answers: 1

Business, 22.06.2019 17:30

If springfield is operating at full employment who is working a. everyone b. about 96% of the workforce c. the entire work force d. the robots

Answers: 1

You know the right answer?

Map shows a concentration, in purple dots, of air release, or emissions, sites across the United Sta...

Questions

Mathematics, 08.03.2021 04:10

Mathematics, 08.03.2021 04:10

Chemistry, 08.03.2021 04:10

Mathematics, 08.03.2021 04:10

Chemistry, 08.03.2021 04:10

Mathematics, 08.03.2021 04:10

Mathematics, 08.03.2021 04:10

Social Studies, 08.03.2021 04:10