Instructions: use the percentage and wage-bracket method to compute federal income taxesto withhold from wages.

Here is the question: Cal is married and has 4 withholding allowances. His semi-monthly salary is $2480.

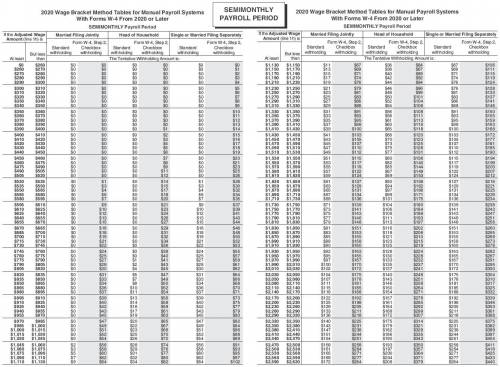

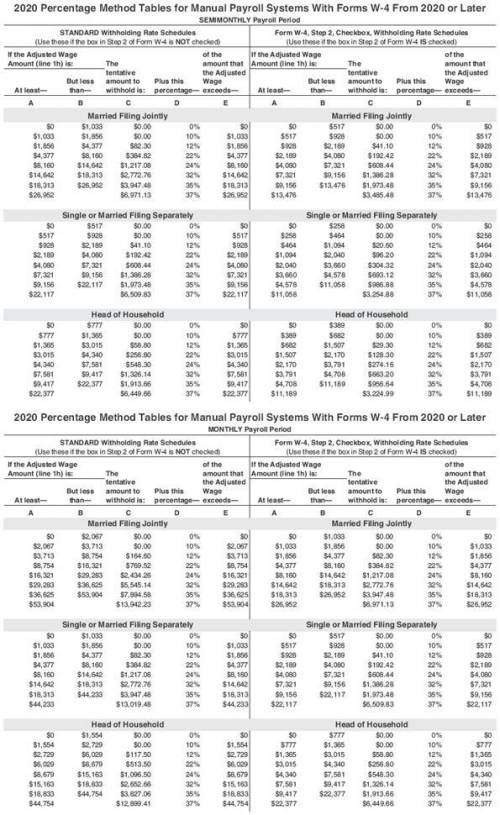

For this problem, the 2020 federal income tax tables for Manual Payroll Systems with Forms W-4 from 2019 or earlier and 2020 FICA rates have been used. See attached.

When I calculated this, I got $138.40 for the percentage method and $158 for the wage bracket method. Both are wrong and they're usually really close to the same number.

Table of Allowance Values for 2020

Weekly 83.00 Biweekly 165.00 Semimonthly 179.00 Monthly 358.00

Quarterly 1,075.00 Semiannual 2,150.00 Annual 4,300.00 Daily/Misc. 17.00

Examples of how to calculate this:

Example 4-12

To compute the tax using the percentage method for Manual Payroll Systems with Forms W-4 or Earlier, follow the steps illustrated below.

Step 1

Determine the amount of gross wages earned, marital status, number of allowances, and frequency of pay. Note: If the wage ends in a fractional dollar amount, the wage may be rounded to the nearest dollar. However, in this text, exact wages are used.

→ Wilson Goodman, single, claims two allowances and earns $915.60 semimonthly.

Step 2

Multiply the number of allowances claimed by the amount of one allowance for the appropriate payroll period, as shown in the Table of Allowance Values in Figure 4.19. → Table of Allowance Values for semimonthly payroll period shows $179.00.

Multiply $179.00 × 2 = $358.00

Step 3

Subtract the amount for the number of allowances claimed from the employee’s gross pay to find the excess of wages over allowances claimed. →

Gross pay $ 915.60

Less: Allowances 358.00

Excess wages $557.60

Step 4

Determine the withholding tax on the excess of wages over allowances claimed by referring to the appropriate Percentage Method Withholding Table. → Compute tax from Tax Table C, page T-15.

($557.60 - $158.00 = $399.60 × 10% = $39.96 + $0) = $39.96

Example 4-13

To use the wage-bracket method tables for Manual Payroll Systems with Forms W-4 From 2019 or Earlier, follow the steps illustrated below.

Step 1

Select the withholding table that applies to the employee’s marital status and pay period.

→ Adrienne Huff is married and claims 3 allowances.

She is paid weekly at a rate of $815.

Step 2

Locate the wage bracket (the first two columns of the table) in which the employee’s gross wages fall. → Locate the appropriate wage bracket (see Figure 4.20):

At least $805 but less than $820

Step 3

Follow the line for the wage bracket across to the right to the column showing the appropriate number of allowances. Withhold this amount of tax. → Move across the line to the column showing 3 allowances.

The tax to withhold is $34.

Answers: 3

Another question on Business

Business, 23.06.2019 02:00

How much more output does the $18 trillion u.s. economy produce when gdp increases by 3.0 percen?

Answers: 1

Business, 23.06.2019 02:00

In his speech on varying explanations of how the earth came into existence, eduardo begins with opinions, moves to inferences, and uses scientific facts in support of his last point. what principle of supporting material organization is eduardo utilizing in his speech?

Answers: 3

Business, 23.06.2019 06:10

Which of the following functions finds the highest value of selected inputs? a. high b. hvalue c. max

Answers: 3

Business, 23.06.2019 14:50

Idont need this written for me but if someone could just come up with an example that can get the process started for me that would be ! research the consumer services industries in united states. choose any one of the consumer services companies and write an essay of about 500 words on how a diverse economy such as the united states can satisfy the needs of its consumers. consider different cultures and languages, services offered to lower socioeconomic populations, or services offered to disabled consumers or women. also analyze the challenges faced by the consumer service industry.

Answers: 1

You know the right answer?

Instructions: use the percentage and wage-bracket method to compute federal income taxesto withhold...

Questions

English, 26.07.2019 23:00

Business, 26.07.2019 23:00

Mathematics, 26.07.2019 23:00

Mathematics, 26.07.2019 23:00

English, 26.07.2019 23:00

Mathematics, 26.07.2019 23:00

Biology, 26.07.2019 23:00

Social Studies, 26.07.2019 23:00

History, 26.07.2019 23:00

Mathematics, 26.07.2019 23:00

History, 26.07.2019 23:00

Social Studies, 26.07.2019 23:00

Biology, 26.07.2019 23:00