Business, 16.10.2021 02:50 mathman783

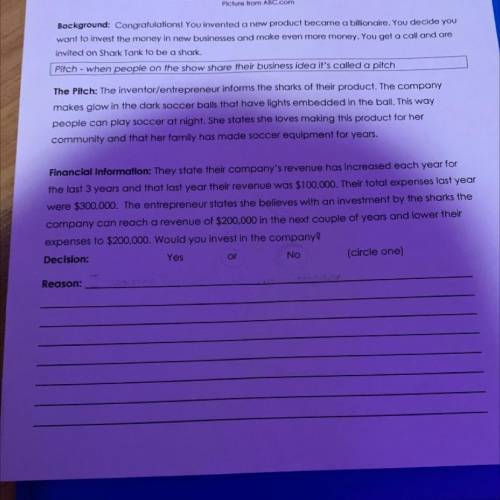

(Your an Investor and want to Invest into something) “They state their company’s revenue has increased each year for the last 3 years and that last year their revune was $100,000. Their total expenses last year were $300,000. The entrepreneur states she believes with an investment by the sharks the company can reach a revenue of $200,000 in the next couple of years and lower expenses to $200,000. Would you invest in the company?”

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

In the rbv are defined as the tangible and intangible assets that a firm controls that it can use to conceive and implement its strategies.answers: management policies

Answers: 1

Business, 22.06.2019 04:50

Harwood company uses a job-order costing system that applies overhead cost to jobs on the basis of machine-hours. the company's predetermined overhead rate of $2.50 per machine-hour was based on a cost formula that estimates $240,000 of total manufacturing overhead for an estimated activity level of 96,000 machine-hours. required: 1. assume that during the year the company works only 91,000 machine-hours and incurs the following costs in the manufacturing overhead and work in process accounts: compute the amount of overhead cost that would be applied to work in process for the year and make the entry in your t-accounts. 2a. compute the amount of underapplied or overapplied overhead for the year and show the balance in your manufacturing overhead t-account. 2b. prepare a journal entry to close the company's underapplied or overapplied overhead to cost of goods sold.

Answers: 1

Business, 22.06.2019 09:30

The 39 percent and 38 percent tax rates both represent what is called a tax "bubble." suppose the government wanted to lower the upper threshold of the 39 percent marginal tax bracket from $335,000 to $208,000. what would the new 39 percent bubble rate have to be? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places,e.g., 32.16.)

Answers: 3

You know the right answer?

(Your an Investor and want to Invest into something)

“They state their company’s revenue has incre...

Questions

Mathematics, 05.03.2020 23:05

Biology, 05.03.2020 23:05

Computers and Technology, 05.03.2020 23:05

English, 05.03.2020 23:05

Computers and Technology, 05.03.2020 23:05