Business, 26.10.2021 01:50 makayladurham19

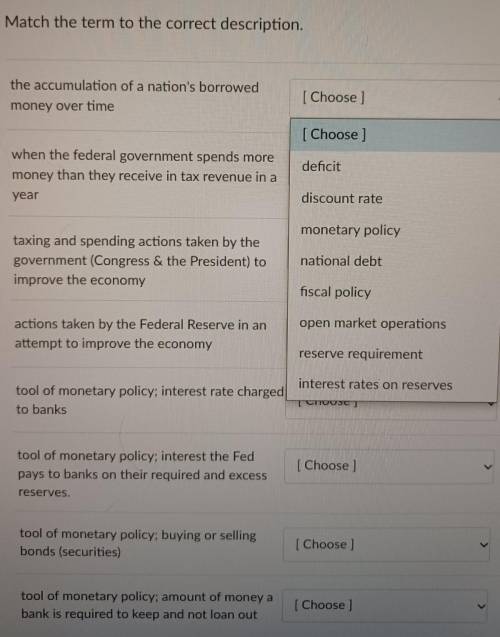

Match the term to the correct description.

the accumulation of a nation's borrowed money over time

when the federal government spends more money than they receive in tax revenue in a year

taxing and spending actions taken by the government (Congress & the President) to improve the economy

actions taken by the Federal Reserve in an attempt to improve the economy

tool of monetary policy; interest rate charged to banks

tool of monetary policy, interest the Fed pays to banks on their required and excess reserves.

tool of monetary policy; buying or selling bonds (securities)

tool of monetary policy; amount of money a bank is required to keep and not loan out

Answers: 2

Another question on Business

Business, 21.06.2019 23:30

Actual usage for the year by the marketing department was 70,000 copies and by the operations department was 330,000 copies. if a dual-rate cost-allocation method is used, what amount of copying facility costs will be budgeted for the operations department?

Answers: 2

Business, 22.06.2019 02:20

Archangel manufacturing calculated a predetermined overhead allocation rate at the beginning of the year based on a percentage of direct labor costs. the production details for the year are given below. calculate the manufacturing overhead allocation rate for the year based on the above data. (round your final answer to two decimal places.) a) 42.42% b) 257.14% c) 235.71% d) 1, 206.90% archangel production details.

Answers: 3

Business, 22.06.2019 02:30

The dollar value generated over decades of customer loyalty to your company is known as brand equity. viability. sustainability. luck.

Answers: 1

Business, 22.06.2019 04:40

Dahlia enterprises needs someone to supply it with 127,000 cartons of machine screws per year to support its manufacturing needs over the next five years, and you’ve decided to bid on the contract. it will cost you $940,000 to install the equipment necessary to start production; you’ll depreciate this cost straight-line to zero over the project’s life. you estimate that in five years, this equipment can be salvaged for $77,000. your fixed production costs will be $332,000 per year, and your variable production costs should be $11.00 per carton. you also need an initial investment in net working capital of $82,000. if your tax rate is 30 percent and your required return is 11 percent on your investment, what bid price should you submit? (do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16))

Answers: 3

You know the right answer?

Match the term to the correct description.

the accumulation of a nation's borrowed money over time...

Questions

Mathematics, 31.07.2019 14:30

Mathematics, 31.07.2019 14:30

History, 31.07.2019 14:30

History, 31.07.2019 14:30

History, 31.07.2019 14:30

Biology, 31.07.2019 14:30

Geography, 31.07.2019 14:30