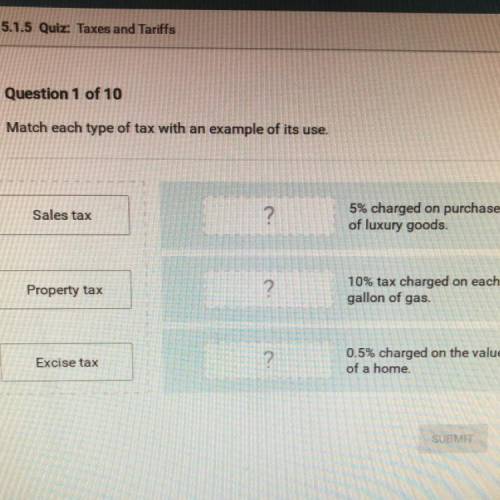

Match each type of tax with an example of its use.

2

5% charged on purchases

of luxury...

Business, 26.10.2021 01:50 madiiiiiii69

Match each type of tax with an example of its use.

2

5% charged on purchases

of luxury goods.

Sales tax

?

10% tax charged on each

gallon of gas.

Property tax

?

0.5% charged on the value

of a home

Excise tax

Answers: 3

Another question on Business

Business, 22.06.2019 07:30

Select the correct answer. sarah works in a coffee house where she is responsible for keying in customer orders. a customer orders snacks and coffee, but later, cancels th snacks, saying she wants only coffee. at the end of the day, sarah finds that there is a mismatch in the snack items ordered. which term suggest data has been violated? a. security b. integrity c. adding d. reliability e. reporting

Answers: 3

Business, 22.06.2019 11:30

12. to produce a textured purée, you would use a/an a. food processor. b. wide-mesh sieve. c. immersion blender d. food mill. student a incorrect which is correct answer?

Answers: 2

Business, 22.06.2019 19:40

Moody corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. at the beginning of the year, the company made the following estimates: machine-hours required to support estimated production 100,000 fixed manufacturing overhead cost $ 650,000 variable manufacturing overhead cost per machine-hour $ 3.00 required: 1. compute the plantwide predetermined overhead rate. 2. during the year, job 400 was started and completed. the following information was available with respect to this job: direct materials $ 450 direct labor cost $ 210 machine-hours used 40

Answers: 3

Business, 22.06.2019 20:20

Levine inc., which produces a single product, has prepared the following standard cost sheet for one unit of the product. direct materials (9 pounds at $1.80 per pound) $16.20 direct labor (6 hours at $14.00 per hour) $84.00 during the month of april, the company manufactures 270 units and incurs the following actual costs. direct materials purchased and used (2,500 pounds) $5,000 direct labor (1,660 hours) $22,908 compute the total, price, and quantity variances for materials and labor.

Answers: 2

You know the right answer?

Questions

English, 18.03.2021 01:20

Mathematics, 18.03.2021 01:20

Mathematics, 18.03.2021 01:20

Social Studies, 18.03.2021 01:20

Mathematics, 18.03.2021 01:20

Mathematics, 18.03.2021 01:20

Social Studies, 18.03.2021 01:20

Social Studies, 18.03.2021 01:20

Mathematics, 18.03.2021 01:20

History, 18.03.2021 01:20

Social Studies, 18.03.2021 01:20