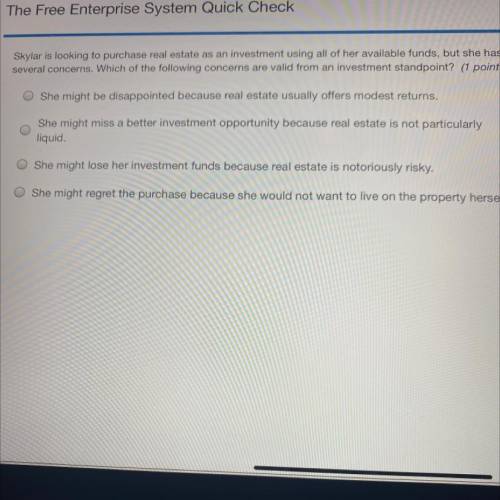

Skylar is looking to purchase real estate as an investment using all of her available funds, but she has

several concerns. Which of the following concerns are valid from an investment standpoint? (1 point)

11

She might be disappointed because real estate usually offers modest returns.

She might miss a better investment opportunity because real estate is not particularly

liquid.

She might lose her investment funds because real estate is notoriously risky.

O She might regret the purchase because she would not want to live on the property herself.

Answers: 1

Another question on Business

Business, 21.06.2019 14:30

When marietta chooses to only purchase a combination of goods that lie within her budget line, she: is decreasing utility. is maximizing utility. likely has negative savings. must reduce the quantity?

Answers: 2

Business, 21.06.2019 22:50

Tara incorporates her sole proprietorship, transferring it to newly formed black corporation. the assets transferred have an adjusted basis of $240,000 and a fair market value of $300,000. also transferred was $10,000 in liabilities, $1,000 of which was personal and the balance of $9,000 being business related. in return for these transfers, tara receives all of the stock in black corporation. a. black corporation has a basis of $241,000 in the property. b. black corporation has a basis of $240,000 in the property. c. tara’s basis in the black corporation stock is $241,000. d. tara’s basis in the black corporation stock is $249,000. e. none of the above.

Answers: 1

Business, 22.06.2019 16:50

Coop inc. owns 40% of chicken inc., both coop and chicken are corporations. chicken pays coop a dividend of $10,000 in the current year. chicken also reports financial accounting earnings of $20,000 for that year. assume coop follows the general rule of accounting for investment in chicken. what is the amount and nature of the book-tax difference to coop associated with the dividend distribution (ignoring the dividends received deduction)?

Answers: 2

Business, 22.06.2019 23:30

Which career pathways require workers to train at special academies? a.emts and emergency dispatchers b.crossing guards and lifeguards c.police officers and firefighters d.lawyers and judges

Answers: 3

You know the right answer?

Skylar is looking to purchase real estate as an investment using all of her available funds, but she...

Questions

Chemistry, 20.04.2020 02:41

Mathematics, 20.04.2020 02:41

Mathematics, 20.04.2020 02:41

Mathematics, 20.04.2020 02:41

Chemistry, 20.04.2020 02:41

Mathematics, 20.04.2020 02:41

Mathematics, 20.04.2020 02:41

Mathematics, 20.04.2020 02:42

Mathematics, 20.04.2020 02:42

Biology, 20.04.2020 02:42

English, 20.04.2020 02:42

Mathematics, 20.04.2020 02:42