Business, 08.11.2021 09:30 avanelson01

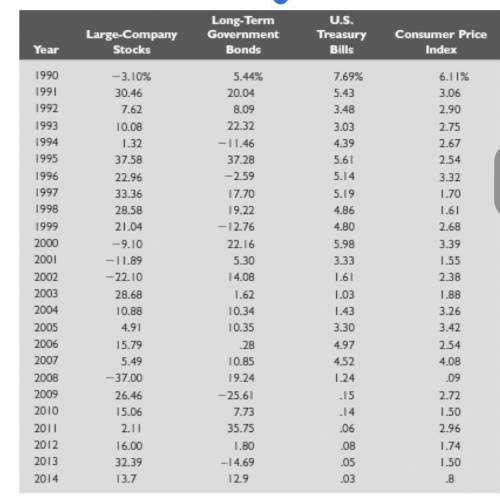

Refer to the following table:

a. Calculate the average return for Treasury bills and the average annual inflation rate (consumer price index) for this period. (5 marks)

b. Calculate the standard deviation of Treasury bill returns and inflation over this period. (5 marks)

c. Calculate the real return for each year. What is the average real return for Treasury bills? (5 marks)

d. Many people consider Treasury bills to be risk-free. What do these calculations tell you about the potential risks of Treasury bills? (5 marks)

Answers: 3

Another question on Business

Business, 22.06.2019 03:50

John is a 45-year-old manager who enjoys playing basketball in his spare time with his teenage sons and their friends. at work he finds that he is better able to solve problems that come up because of his many years of experience, but while on the court, he finds he is not as good keeping track of the ball while worrying about the other players. john's experience is:

Answers: 1

Business, 22.06.2019 12:50

You own 2,200 shares of deltona hardware. the company has stated that it plans on issuing a dividend of $0.42 a share at the end of this year and then issuing a final liquidating dividend of $2.90 a share at the end of next year. your required rate of return on this security is 16 percent. ignoring taxes, what is the value of one share of this stock to you today?

Answers: 1

Business, 22.06.2019 14:40

You are purchasing a bond that currently sold for $985.63. it has the time-to-maturity of 10 years and a coupon rate of 6%, paid semi-annually. the bond can be called for $1,020 in 3 years. what is the yield to maturity of this bond?

Answers: 2

Business, 22.06.2019 16:00

Winners of the georgia lotto drawing are given the choice of receiving the winning amount divided equally over 2121 years or as a lump-sum cash option amount. the cash option amount is determined by discounting the annual winning payment at 88% over 2121 years. this week the lottery is worth $1616 million to a single winner. what would the cash option payout be?

Answers: 3

You know the right answer?

Refer to the following table:

a. Calculate the average return for Treasury bills and the average a...

Questions

Mathematics, 25.11.2021 14:00

History, 25.11.2021 14:00

Chemistry, 25.11.2021 14:00

History, 25.11.2021 14:00

Physics, 25.11.2021 14:00

Health, 25.11.2021 14:00

Business, 25.11.2021 14:00

History, 25.11.2021 14:00

Computers and Technology, 25.11.2021 14:00

Mathematics, 25.11.2021 14:00

Mathematics, 25.11.2021 14:00

Mathematics, 25.11.2021 14:00