Make a Claim

Dana needs to use the information from her 1098-T form to determine if

she qual...

Make a Claim

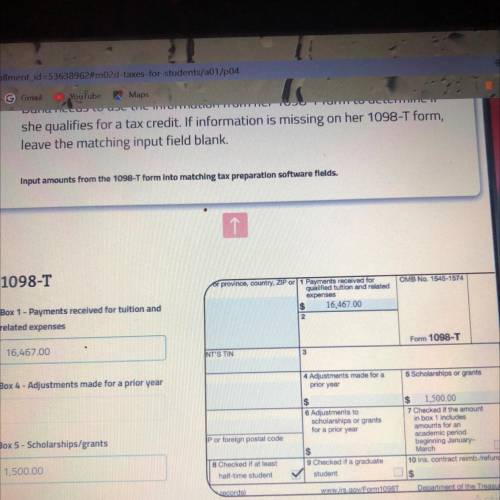

Dana needs to use the information from her 1098-T form to determine if

she qualifies for a tax credit. If information is missing on her 1098-T form,

leave the matching input field blank.

Input amounts from the 1098-T form into matching tax preparation software fields.

Answers: 2

Another question on Business

Business, 21.06.2019 17:40

Carlos would like to start saving for his son’s college expenses. which type of savings account should carlos open? ida money market 529 plan basic savings account

Answers: 2

Business, 22.06.2019 04:00

Wallis company manufactures only one product and uses a standard cost system. the company uses a predetermined plantwide overhead rate that relies on direct labor-hours as the allocation base. all of the company's manufacturing overhead costs are fixed—it does not incur any variable manufacturing overhead costs. the predetermined overhead rate is based on a cost formula that estimated $2,886,000 of fixed manufacturing overhead for an estimated allocation base of 288,600 direct labor-hours. wallis does not maintain any beginning or ending work in process inventory.

Answers: 2

Business, 22.06.2019 06:00

If you miss two payments on a credit card what is generally the penalty

Answers: 1

Business, 22.06.2019 07:40

Shelby company produces three products: product x, product y, and product z. data concerning the three products follow (per unit): product x product y product z selling price $ 85 $ 65 $ 75 variable expenses: direct materials 25.50 19.50 5.25 labor and overhead 25.50 29.25 47.25 total variable expenses 51.00 48.75 52.50 contribution margin $ 34.00 $ 16.25 $ 22.50 contribution margin ratio 40 % 25 % 30 % demand for the company’s products is very strong, with far more orders each month than the company can produce with the available raw materials. the same material is used in each product. the material costs $8 per pound, with a maximum of 4,400 pounds available each month. required: a. compute contribution margin per pound of materials used. (round your intermediate calculations and final answers to 2 decimal places.) contribution margin per pound product x $ product y $ product z $ b. which orders would you advise the company to accept first, those for product x, for product y, or for product z? which orders second? third? product x product y product z

Answers: 3

You know the right answer?

Questions

History, 03.11.2020 02:40

Mathematics, 03.11.2020 02:40

Mathematics, 03.11.2020 02:40

Mathematics, 03.11.2020 02:40

Mathematics, 03.11.2020 02:40

Geography, 03.11.2020 02:40

Biology, 03.11.2020 02:40

Mathematics, 03.11.2020 02:40

Mathematics, 03.11.2020 02:40

Geography, 03.11.2020 02:40

Chemistry, 03.11.2020 02:40