Business, 25.11.2021 06:20 mathhelper22

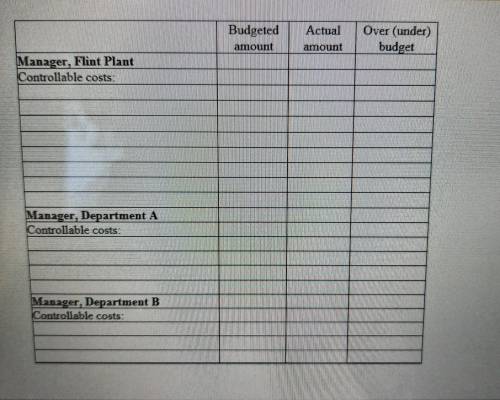

1. Marsha Hansen, the manager of the Flint Plant of the Michigan Company is responsible for all of the plant's costs except her own salary. There are two operating departments within the plant, Departments A and B. Each department has its own manager. There is also a maintenance department that provides services equally to the two operating departments. The following information is available. Budget Actual Employee Wages Depratment: A. $3,500 B. $4,000 Total: $7,500 A. 3,200 B. 4,700 Total: $7,900 Manager's Salary: A. 800 B. 800 Total. 1,600 A. 800 B. 800 Total. 1,600 Supplies: A. 750 B. 600 Total: 1,350 A. 700 B. 590 Total. 1,290 Building rent: A. 1,500 B. 1,500 Total. 3,000 A. 1,400 B. 1,400 Total. 2,800 Utilities: A. 300 B. 300 Total. 600 A. 375 B. 375 Total. 750 Maintenance: A. 3,300 B. 3,300 Total. 6,600 A. 3,000 B. 3,000 Total. 6,000 Totals: A. $10,150 B. $10,500 Total. $20,650 A. $9,475 B. $10,865 Total. $20,340 Departments managers are responsible for the wages and supplies in their department. They are not responsible for their own salary. Building rents, utilities, and maintenance are allocated to each department based on square footage. Required: Complete the responsibility accounting performance reports below that list costs controllable by the manager of Department A, the manager of Department B, and the manager of the Flint plant. Template is in the picture. Please answer Thank you.

Answers: 1

Another question on Business

Business, 21.06.2019 16:30

Calculate the required rate of return for an asset that has a beta of 1.73, given a risk-free rate of 5.3% and a market return of 9.9%. b. if investors have become more risk-averse due to recent geopolitical events, and the market return rises to 12.7%, what is the required rate of return for the same asset?

Answers: 2

Business, 22.06.2019 01:20

Which of the following statements concerning an organization's strategy is true? a. cost accountants formulate strategy in an organization since they have more inputs about costs. b. businesses usually follow one of two broad strategies: offering a quality product at a high price, or offering a unique product or service priced lower than the competition. c. a good strategy will always overcome poor implementation. d. strategy specifies how an organization matches its own capabilities with the opportunities in the marketplace to accomplish its objectives.

Answers: 1

Business, 22.06.2019 08:10

Exercise 15-7 crawford corporation incurred the following transactions. 1. purchased raw materials on account $53,000. 2. raw materials of $45,200 were requisitioned to the factory. an analysis of the materials requisition slips indicated that $9,400 was classified as indirect materials. 3. factory labor costs incurred were $65,400, of which $50,200 pertained to factory wages payable and $15,200 pertained to employer payroll taxes payable. 4. time tickets indicated that $55,000 was direct labor and $10,400 was indirect labor. 5. manufacturing overhead costs incurred on account were $81,700. 6. depreciation on the company’s office building was $8,100. 7. manufacturing overhead was applied at the rate of 160% of direct labor cost. 8. goods costing $89,400 were completed and transferred to finished goods. 9. finished goods costing $76,000 to manufacture were sold on account for $105,100. journalize the transactions. (credit account titles are automatically indented when amount is entered. do not indent manually.) no. account titles and explanation debit credit (1) (2) (3) (4) (5) (6) (7) (8) (9) (to record the sale) (to record the cost of the sale) click if you would like to show work for this question: open show work

Answers: 1

Business, 22.06.2019 11:30

Mai and chuck have been divorced since 2012. they have three boys, ages 6, 8, and 10. all of the boys live with mai and she receives child support from chuck. mai and chuck both work and the boys need child care before and after school. te boys attend the fun house day care center and mai paid them $2,000 and chuck paid them $3,000. mai's agi is $18,000 and chuck's is $29,000. mai will claim two of the boys as dependents. she signed form 8332 which allows chuck to claim one of the boys. who can take the child and dependent care credit?

Answers: 3

You know the right answer?

1. Marsha Hansen, the manager of the Flint Plant of the Michigan Company is responsible for all of t...

Questions

English, 11.09.2020 14:01

Mathematics, 11.09.2020 14:01

Social Studies, 11.09.2020 14:01

Mathematics, 11.09.2020 14:01

Mathematics, 11.09.2020 14:01

English, 11.09.2020 14:01

Mathematics, 11.09.2020 14:01

Mathematics, 11.09.2020 14:01

Mathematics, 11.09.2020 14:01

Mathematics, 11.09.2020 14:01

Mathematics, 11.09.2020 14:01

Mathematics, 11.09.2020 14:01

Mathematics, 11.09.2020 14:01

Mathematics, 11.09.2020 14:01

Mathematics, 11.09.2020 14:01

Spanish, 11.09.2020 14:01

Mathematics, 11.09.2020 14:01

Mathematics, 11.09.2020 14:01

History, 11.09.2020 14:01

Mathematics, 11.09.2020 14:01