SEE ATTACHMENTS

Lancer, Inc. (a U. S.-based company), establishes a subsidiary in Croatia on January 1, 2019. The following account balances for the year ending December 31, 2020, are stated in kuna (K), the local currency:

Sales K 200,000

Inventory (bought on 3/1/20) 100,000

Equipment (bought on 1/1/19) 60,000

Rent expense 12,000

Dividends (declared on 10/1/20) 22,000

Notes receivable (to be collected in 2023) 36,000

Accumulated depreciation—equipment 18,000

Salary payable 5,000

Depreciation expense 6,000

The following U. S.$ per kuna exchange rates are applicable:

January 1, 2019 $0.19

Average for 2019 0.20

January 1, 2020 0.24

March 1, 2020 0.25

October 1, 2020 0.27

December 31, 2020 0.28

Average for 2020 0.26

Lancer is preparing account balances to produce consolidated financial statements.

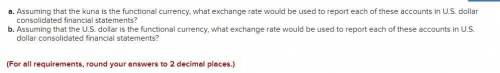

Assuming that the kuna is the functional currency, what exchange rate would be used to report each of these accounts in U. S. dollar consolidated financial statements?

Assuming that the U. S. dollar is the functional currency, what exchange rate would be used to report each of these accounts in U. S. dollar consolidated financial statements?

(For all requirements, round your answers to 2 decimal places.)

Answers: 1

Another question on Business

Business, 22.06.2019 03:50

Suppose that a worker in agland can produce either 10 units of organic grain or 2 units of incense per year, and a worker in zenland can produce either 5 units of organic grain or 15 units of incense per year. there are 20 workers in agland and 10 workers in zenland. currently the two countries do not trade. agland produces and consumes 100 units of grain and 20 units of incense per year. zenland produces and consumes 50 units of grain and no incense per year. if each country made the decision to specialize in producing the good in which it has a comparative advantage, then the combined yearly output of the two countries would increase by a. 30 units of grain and 100 units of incense. b. 30 units of grain and 150 units of incense. c. 50 units of grain and 90 units of incense. d. 50 units of grain and 130 units of ince

Answers: 1

Business, 22.06.2019 18:00

Bond j has a coupon rate of 6 percent and bond k has a coupon rate of 12 percent. both bonds have 14 years to maturity, make semiannual payments, and have a ytm of 9 percent. a. if interest rates suddenly rise by 2 percent, what is the percentage price change of these bonds?

Answers: 2

Business, 22.06.2019 19:10

Fortress international, a large conglomerate, procures a few component parts from external suppliers and also manufactures some of the key raw materials in its own subsidiaries. aside from this, the company does not solely depend on outside distributors to reach its customers. in fact, it has its own retail stores to distribute its products. in this scenario, which of the following alternatives to vertical integration is fortress international applying? a. concentric integration b. taper integration c. horizontal integration d. conglomerate integration

Answers: 1

Business, 22.06.2019 20:30

John and daphne are saving for their daughter ellen's college education. ellen just turned 10 at (t = 0), and she will be entering college 8 years from now (at t = 8). college tuition and expenses at state u. are currently $14,500 a year, but they are expected to increase at a rate of 3.5% a year. ellen should graduate in 4 years--if she takes longer or wants to go to graduate school, she will be on her own. tuition and other costs will be due at the beginning of each school year (at t = 8, 9, 10, and 11).so far, john and daphne have accumulated $15,000 in their college savings account (at t = 0). their long-run financial plan is to add an additional $5,000 in each of the next 4 years (at t = 1, 2, 3, and 4). then they plan to make 3 equal annual contributions in each of the following years, t = 5, 6, and 7. they expect their investment account to earn 9%. how large must the annual payments at t = 5, 6, and 7 be to cover ellen's anticipated college costs? a. $1,965.21b. $2,068.64c. $2,177.51d. $2,292.12e. $2,412.76

Answers: 1

You know the right answer?

SEE ATTACHMENTS

Lancer, Inc. (a U. S.-based company), establishes a subsidiary in Croatia on Janua...

Questions

Mathematics, 09.08.2019 17:20

History, 09.08.2019 17:20

Biology, 09.08.2019 17:20

Biology, 09.08.2019 17:20

Biology, 09.08.2019 17:20