Business, 14.12.2021 03:30 user1234573

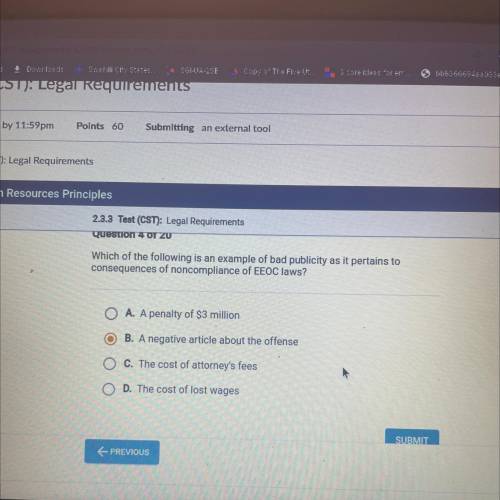

Which of the following is an example of bad publicity as it pertains to

consequences of noncompliance of EEOC laws?

O A. A penalty of $3 million

B. A negative article about the offense

O C. The cost of attorney's fees

O D. The cost of lost wages

Answers: 2

Another question on Business

Business, 21.06.2019 12:30

Read about wanda’s complaint to the fdic. what action did the regulator most likely take in this case? the fdic found out that a company misreported information to a credit scoring company about wanda. wanda contacted the company and asked them to fix the problem. the company refused to talk about it and referred her back to the credit company. the fdic declares the company has violated the .

Answers: 1

Business, 22.06.2019 03:00

Compare the sources of consumer credit 1. consumers use a prearranged loan using special checks 2. consumers use cards with no interest and non -revolving balances 3. consumers pay off debt and credit is automatically renewed 4. consumers take out a loan with a repayment date and have a specific purpose a. travel and entertainment credit b. revolving check credit c. closed-end credit d. revolving credit

Answers: 1

Business, 22.06.2019 09:30

The 39 percent and 38 percent tax rates both represent what is called a tax "bubble." suppose the government wanted to lower the upper threshold of the 39 percent marginal tax bracket from $335,000 to $208,000. what would the new 39 percent bubble rate have to be? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places,e.g., 32.16.)

Answers: 3

Business, 22.06.2019 15:20

Martinez company has the following two temporary differences between its income tax expense and income taxes payable. 2017 2018 2019 pretax financial income $873,000 $866,000 $947,000 (2017' 2018, 2019) excess depreciation expense on tax return (29,400 ) (39,000 ) (9,600 ) (2017' 2018, 2019) excess warranty expense in financial income 20,000 9,900 8,300 (2017' 2018, 2019) taxable income $863,600 $836,900 $945,700(2017' 2018, 2019) the income tax rate for all years is 40%. instructions: a. prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2017, 2018, and 2019. b. assuming there were no temporary differences prior to 2016, indicate how deferred taxes will be reported on the 2016 balance sheet. button's warranty is for 12 months. c. prepare the income tax expense section of the income statement for 2017, beginning with the line, "pretax financial income."

Answers: 3

You know the right answer?

Which of the following is an example of bad publicity as it pertains to

consequences of noncomplia...

Questions

Mathematics, 08.11.2019 22:31

Biology, 08.11.2019 22:31

Mathematics, 08.11.2019 22:31

Chemistry, 08.11.2019 22:31

Computers and Technology, 08.11.2019 22:31

Computers and Technology, 08.11.2019 22:31