Business, 16.12.2021 02:50 amylumey2005

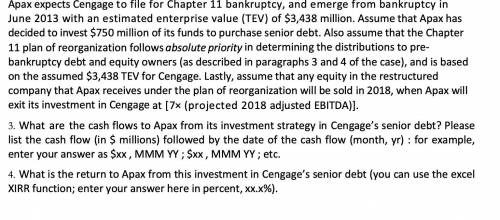

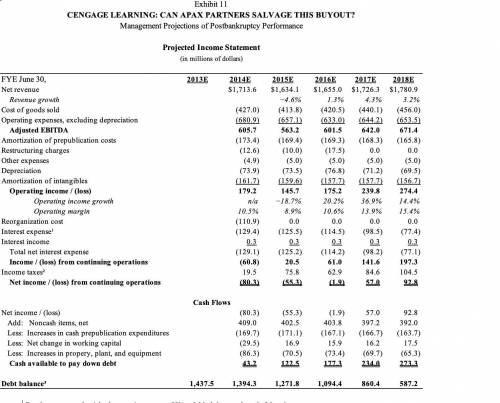

How would I calculate the cash flows from the income statement given and using the additional Information given in the first image provided? How could I also get the return from the debt investment?

Answers: 1

Another question on Business

Business, 21.06.2019 16:30

Collective bargaining provides for a representative of employees to negotiate with a representative of management over labor issues including wages.true or false?

Answers: 3

Business, 21.06.2019 22:00

Email viruses are typically launched by people who modify header information to hide their identity. brightmail's enrique salem says that in the future, your email reader will authenticate the sender before putting hte message in your inbox. that way, you will know the source of all the emails you read. alan nugent of novell says, "i'm kind of a fan of eliminating anonymity if that is the price for security." will eliminating anonymity make computers more secure?

Answers: 3

Business, 22.06.2019 04:30

Jennifer purchased a house in a brand new development in the outskirts of town. when her house was built, the nearest fire department was nearly 20 miles away. as her neighborhood developed, the density of the community called for a new fire department 1.5 miles away. what effect will the new fire station have on her homeowners insurance premium? a. a new fire department will be more demanding on local taxes. her annual premium will go up. b. the location of a fire department has no bearing on the value of her house. her annual premium will stay the same. c. the new fire department will reduce the risk of financial loss in her home. her annual premium should decrease. d. with a fire department so close (less than 5 miles), financial risk on jennifer’s home practically disappears. she will not need to pay insurance anymore.

Answers: 1

Business, 22.06.2019 09:40

Alpha industries is considering a project with an initial cost of $8 million. the project will produce cash inflows of $1.49 million per year for 8 years. the project has the same risk as the firm. the firm has a pretax cost of debt of 5.61 percent and a cost of equity of 11.27 percent. the debt–equity ratio is .60 and the tax rate is 35 percent. what is the net present value of the project?

Answers: 1

You know the right answer?

How would I calculate the cash flows from the income statement given and using the additional Inform...

Questions

Mathematics, 21.07.2021 06:40

Mathematics, 21.07.2021 06:40

History, 21.07.2021 06:40

English, 21.07.2021 06:40

Physics, 21.07.2021 06:40

Social Studies, 21.07.2021 06:40

Mathematics, 21.07.2021 06:40

Chemistry, 21.07.2021 06:40

History, 21.07.2021 06:40

Mathematics, 21.07.2021 06:40

Mathematics, 21.07.2021 06:40