Business, 31.12.2021 17:50 thomascoop85

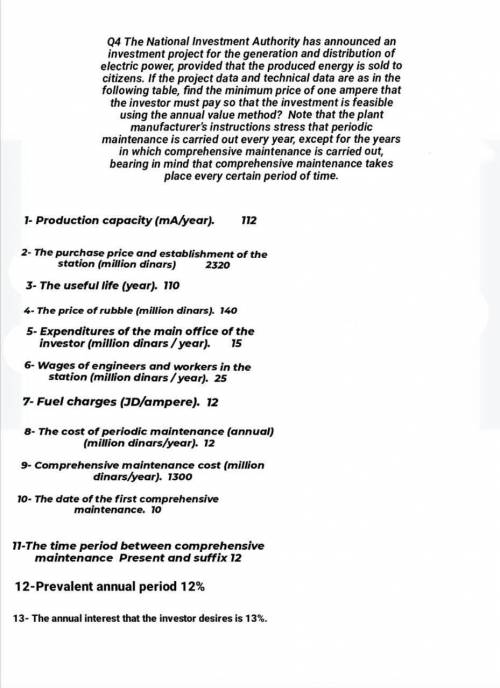

The National Investment Authority has announced an investment project for the generation and distribution of electric power, provided that the produced energy is sold to citizens. If the project data and technical data are as in the following table, find the minimum price of one ampere that the investor must pay so that the investment is feasible using the annual value method? Note that the plant manufacturer's instructions stress that periodic maintenance is carried out every year, except for the years in which comprehensive maintenance is carried out, bearing in mind that comprehensive maintenance takes place every certain period of time. 1- Production capacity (mA/year). 112 2- The purchase price and establishment of the station (million dinars) 2320 3- The useful life (year). 110 4- The price of rubble (million dinars). 140 5- Expenditures of the main office of the investor (million dinars /year). 15 6- Wages of engineers and workers in the station (million dinars/year). 25 7- Fuel charges (JD/ampere). 12 8- The cost of periodic maintenance (annual) (million dinars/year). 12 9- Comprehensive maintenance cost (million dinars/year). 1300 10- The date of the first comprehensive maintenance. 10 11-The time period between comprehensive maintenance Present and suffix 12 12-Prevalent annual period 12% 13- The annual interest that the investor desires is 13%.

Answers: 3

Another question on Business

Business, 20.06.2019 18:04

What is the best way for the inventor to protect his/her investment if the invention of a new composite material for turbofan blades is susceptible to reverse engineering?

Answers: 1

Business, 21.06.2019 20:30

Suppose the price of a complement to lcd televisions rises. what effect will this have on the market equilibrium for lcd tvs?

Answers: 1

Business, 21.06.2019 20:40

On december 31, 2011, daggett company issued $750,000 of ten-year, 9% bonds payable for $700,353, yielding an effective interest rate of 10%. interest is payable semiannually on june 30 and december 31. prepare journal entries to reflect (a) the issuance of the bonds, (b) the semiannual interest payment and discount amortization (effective interest method) on june 30, 2012, and (c) the semiannual interest payment and discount amortization on december 31, 2012. round amounts to the nearest dollar.

Answers: 2

Business, 22.06.2019 17:30

What do you think: would it be more profitable to own 200 shares of penny’s pickles or 1 share of exxon? why do you think that?

Answers: 1

You know the right answer?

The National Investment Authority has announced an investment project for the generation and distrib...

Questions

History, 26.02.2021 21:50

Mathematics, 26.02.2021 21:50

Chemistry, 26.02.2021 21:50

Mathematics, 26.02.2021 21:50

Mathematics, 26.02.2021 21:50

Mathematics, 26.02.2021 21:50

Mathematics, 26.02.2021 21:50

Mathematics, 26.02.2021 21:50

History, 26.02.2021 21:50