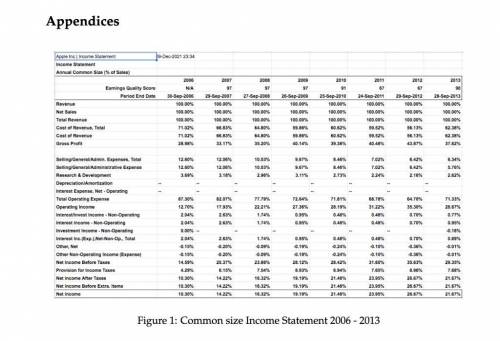

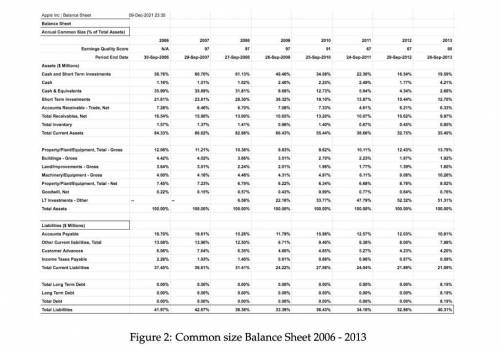

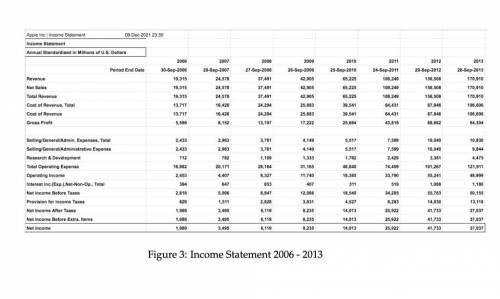

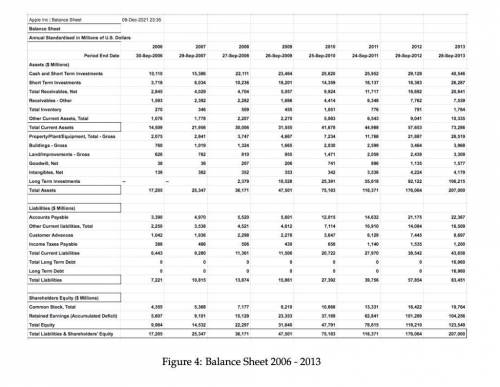

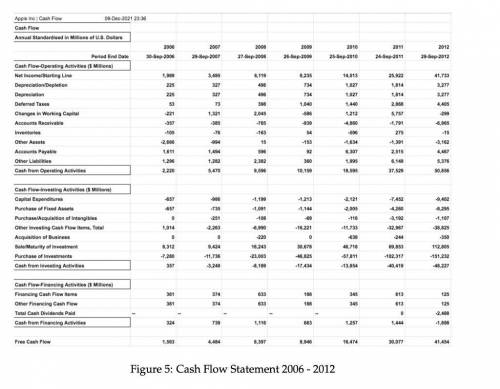

1. From its peak in September 2012 to the end of March 2013, Apple’s stock price fell by

37%, from $702.10 to $442.66. Examine ONLY the financial reports (in the appendices)

and identify areas that were responsible for this stock performance.

2. State the amount of cash holdings Apple reported in their 2020 annual report (10-k)1 and state Apple’s plan to disburse cash holdings for 2020 and beyond.

Answers: 2

Another question on Business

Business, 22.06.2019 12:00

Suppose there are three types of consumers who attend concerts at your university’s performing arts center: students, staff, and faculty. each of these groups has a different willingness to pay for tickets; within each group, willingness to pay is identical. there is a fixed cost of $1,000 to put on a concert, but there are essentially no variable costs. for each concert: i. there are 140 students willing to pay $20. (ii) there are 200 staff members willing to pay $35. (iii) there are 100 faculty members willing to pay $50. a) if the performing arts center can charge only one price, what price should it charge? what are profits at this price? b) if the performing arts center can price discriminate and charge two prices, one for students and another for faculty/staff, what are its profits? c) if the performing arts center can perfectly price discriminate and charge students, staff, and faculty three separate prices, what are its profits?

Answers: 1

Business, 22.06.2019 15:20

Gulliver travel agencies thinks interest rates in europe are low. the firm borrows euros at 5 percent for one year. during this time period the dollar falls 11 percent against the euro. what is the effective interest rate on the loan for one year? (consider the 11 percent fall in the value of the dollar as well as the interest payment.)

Answers: 2

Business, 22.06.2019 16:30

En major recording acts are able to play at the stadium. if the average profit margin for a concert is $175,000, how much would the stadium clear for all of these events combined?

Answers: 3

Business, 22.06.2019 17:30

Four students are at an extracurricular activity fair at their high school and are trying to decide which clubs to join. some information about the students is listed in this chart: which describes which ctso each student should join?

Answers: 1

You know the right answer?

1. From its peak in September 2012 to the end of March 2013, Apple’s stock price fell by

37%, from...

Questions

History, 29.06.2019 16:00

English, 29.06.2019 16:00

Mathematics, 29.06.2019 16:00

Social Studies, 29.06.2019 16:00

Physics, 29.06.2019 16:00

Physics, 29.06.2019 16:00

Mathematics, 29.06.2019 16:00

World Languages, 29.06.2019 16:00