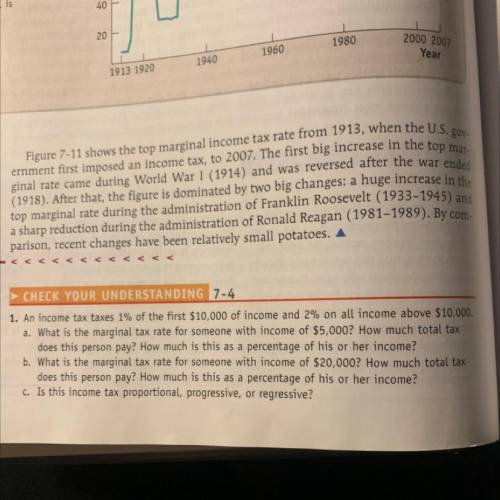

1. An income tax taxes 1% of the first $10,000 of income and 2% on all income above $10,000.

...

Business, 04.02.2022 14:50 pandamaknae2003

1. An income tax taxes 1% of the first $10,000 of income and 2% on all income above $10,000.

Answers: 2

Another question on Business

Business, 20.06.2019 18:04

The chart shows a production possibilities schedule for sabrina’s soccer. combination: soccer balls: soccer nets: a 10 0 b 8 1 c 6 2 d 4 3 e 2 4 f 0 5 which statement correctly explains the chart? a. the opportunity cost of producing one soccer net is eight soccer balls. b. the opportunity cost of producing two soccer nets is two soccer balls. c. the opportunity cost of producing two soccer balls is one soccer net. d. the opportunity cost of producing four soccer balls is three soccer nets.

Answers: 1

Business, 21.06.2019 22:00

The market yield on spice grills' bonds is 15%, and the firm's marginal tax rate is 33%. what is their shareholders' required return if the equity risk premium is 4%?

Answers: 1

Business, 22.06.2019 09:50

phillips, inc. had the following financial data for the year ended december 31, 2019. cash $ 41,000 cash equivalents 75,000 long term investments 59,000 total current liabilities 149,000 what is the cash ratio as of december 31, 2019, for phillips, inc.? (round your answer to two decimal places.)

Answers: 3

Business, 22.06.2019 12:10

The following transactions occur for badger biking company during the month of june: a. provide services to customers on account for $32,000. b. receive cash of $24,000 from customers in (a) above. c. purchase bike equipment by signing a note with the bank for $17,000. d. pay utilities of $3,200 for the current month. analyze each transaction and indicate the amount of increases and decreases in the accounting equation. (decreases to account classifications should be entered as a negative.)

Answers: 1

You know the right answer?

Questions

Geography, 03.10.2019 11:10

Mathematics, 03.10.2019 11:10

Mathematics, 03.10.2019 11:10

English, 03.10.2019 11:10

English, 03.10.2019 11:10

Mathematics, 03.10.2019 11:10

Mathematics, 03.10.2019 11:10

Physics, 03.10.2019 11:10