Web Wizard Incorporated, has provided information technology services for several years. For the first two months of the

current year the company has used the percentage of credit sales method to estimate bad debts. At the end of the first

quarter the company switched to the aging of accounts receivable method. The company entered into the following

partial list of transactions during the first quarter

2. During January, the company provided services for $37000 on credit

b. On January 31 the company estimated bad debts using 2 percent of credit sales.

On February 4 the company collected $18.500 of accounts receivable

d on February 15, the company wrote off $150 account receivable.

e During February, the company provided services for $27,000 on credit

On February 28 the company estimated bad debts using 2 percent of credit sales

On March 1 the company loaned $2.600 to an employee, who signed a 6% note, due in 6 months

h On March 15. the company collected $150 on the account written off one month earlier

On March 31 the company accrued interest earned on the note.

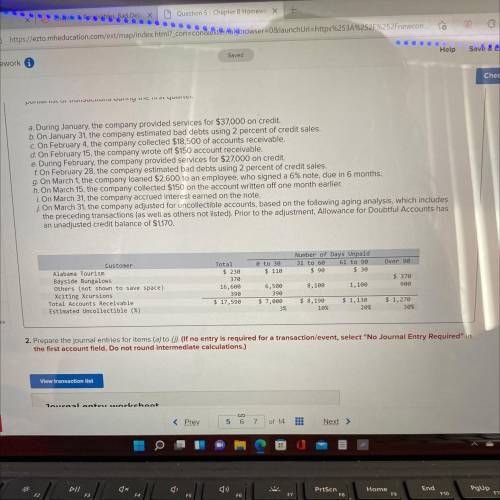

On March 31. the company adjusted for uncollectible accounts, based on the following aging analysis, which includes

the preceding transactions as well as others not listed). Prior to the adjustment. Allowance for Doubtful Accounts has

an unadjusted credit balance of $1170

Total

5.230

Number of Days Unpaid

31 to be 61 to

$9

Over

$ 110

Customer

A Touri

Bayside bungalows

Others to show to save space)

xciting Xcursions

Total Accounts Receivable

Estimated collectie

16.00

5370

5.50

39

3.100

1.100

$17.500

S 3.1

5.1.1

5 1.270

103

Answers: 3

Another question on Business

Business, 22.06.2019 12:30

Acorporation a. can use different depreciation methods for tax and financial reporting purposes b. must use the straight - line depreciation method for tax purposes and double declining depreciation method financial reporting purposes c. must use different depreciation method for tax purposes, but strictly mandated depreciation methods for financial reporting purposes d. can use straight- line depreciation method for tax purposes and macrs depreciation method financial reporting purposes

Answers: 2

Business, 22.06.2019 12:50

Required information problem 15-1a production costs computed and recorded; reports prepared lo c2, p1, p2, p3, p4 [the following information applies to the questions displayed below. marcelino co.'s march 31 inventory of raw materials is $84,000. raw materials purchases in april are $540,000, and factory payroll cost in april is $364,000. overhead costs incurred in april are: indirect materials, $59,000; indirect labor, $26,000; factory rent, $38,000; factory utilities, $19,000; and factory equipment depreciation, $58,000. the predetermined overhead rate is 50% of direct labor cost. job 306 is sold for $670,000 cash in april. costs of the three jobs worked on in april follow. job 306 job 307 job 308 balances on march 31 direct materials $30,000 $36,000 direct labor 25,000 14,000 applied overhead 12,500 7,000 costs during april direct materials 133,000 210,000 $100,000 direct labor 105,000 150,000 101,000 applied overhead ? ? ? status on april 30 finished (sold) finished in process (unsold) required: 1. determine the total of each production cost incurred for april (direct labor, direct materials, and applied overhead), and the total cost assigned to each job (including the balances from march 31). a-materials purchases (on credit). b-direct materials used in production. c-direct labor paid and assigned to work in process inventory. d-indirect labor paid and assigned to factory overhead. e-overhead costs applied to work in process inventory. f-actual overhead costs incurred, including indirect materials. (factory rent and utilities are paid in cash.) g-transfer of jobs 306 and 307 to finished goods inventory. h-cost of goods sold for job 306. i-revenue from the sale of job 306. j-assignment of any underapplied or overapplied overhead to the cost of goods sold account. (the amount is not material.) 2. prepare journal entries for the month of april to record the above transactions. 3. prepare a schedule of cost of goods manufactured. 4.1 compute gross profit for april. 4.2 show how to present the inventories on the april 30 balance sheet.

Answers: 3

Business, 22.06.2019 18:50

Dominic is the founder of an innovative "impromptu catering" business that provides elegant, healthy party food and decorations on less than 24 hours' notice. the company has grown by over 150 percent in the past year. dominic credits some of the company's success to studying the strategies of prominent social entrepreneurs, such as wikipedia's jimmy wales. what can dominic do to exemplify the social entrepreneurship model?

Answers: 2

Business, 22.06.2019 23:00

The discussion of the standards for selection of peanuts that will be used in m& ms and the placement of the m& m logo on the candies speaks to which building block of a sustainable competitive advantage:

Answers: 1

You know the right answer?

Web Wizard Incorporated, has provided information technology services for several years. For the fir...

Questions

History, 26.01.2020 06:31

Mathematics, 26.01.2020 06:31

Mathematics, 26.01.2020 06:31

Computers and Technology, 26.01.2020 06:31

Mathematics, 26.01.2020 06:31

Biology, 26.01.2020 06:31

Mathematics, 26.01.2020 06:31

German, 26.01.2020 06:31

English, 26.01.2020 06:31

SAT, 26.01.2020 06:31

Business, 26.01.2020 06:31

Mathematics, 26.01.2020 06:31

Mathematics, 26.01.2020 06:31