Business, 03.07.2019 15:40 dontcareanyonemo

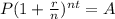

If the interest rate on a savings account is 0.018%, approximately how much money do you need to keep in this account for 1 year to earn enough interest to cover a single $9.99 below-minimum-balance fee?

Answers: 1

Another question on Business

Business, 23.06.2019 02:00

Imprudential, inc., has an unfunded pension liability of $572 million that must be paid in 25 years. to assess the value of the firm’s stock, financial analysts want to discount this liability back to the present. if the relevant discount rate is 6.5 percent, what is the present value of this liability? (do not round intermediate calculations and enter your answer in dollars, not millions, rounded to 2 decimal places, e.g., 1,234,567.89)

Answers: 3

Business, 23.06.2019 02:00

True of false: the chancellor of a university has commissioned a team to collect data on students' gpas and the amount of time they spend bar hopping every week (measured in minutes). he wants to know if imposing much tougher regulations on all campus bars to make it more difficult for students to spend time in any campus bar will have a significant impact on general students' gpas. his team should use a t test on the slope of the population regression.

Answers: 1

Business, 23.06.2019 02:40

P8-4b dropping unfavorable division based on the following analysis of last year's operations of groves, inc., a financial vice president of the company believes that the firm's total net income could be increased by $160,000 if its design division were discontinued. (amounts are given in the thousands of dollars.) required provide answers for each of the following independent situations: a. assuming that total fixed costs and expenses would not be affected by discontinuing the design division, prepare an analysis showing why you agree or disagree with the vice president. b. assume that the discontinuance of the design division will enable the company to avoid 30% of the fixed portion of cost of services and 40% of the fixed operating expenses allocated to the design division. calculate the resulting effect on net income. c. assume that in addition to the cost avoidance in requirement (b), the capacity released by discontinuance of the design division can be used to provide 6,000 new services that would have a variable cost per service of $60 and would require additional fixed costs totaling $68,000. at what unit price must the new service be sold if groves is to increase its total net income by $180,000?

Answers: 2

Business, 23.06.2019 12:00

Whats a person that is involved in the business of buying and selling home

Answers: 2

You know the right answer?

If the interest rate on a savings account is 0.018%, approximately how much money do you need to kee...

Questions

English, 28.04.2021 21:00

Mathematics, 28.04.2021 21:00

Mathematics, 28.04.2021 21:00

Mathematics, 28.04.2021 21:00

SAT, 28.04.2021 21:00

Mathematics, 28.04.2021 21:00

Chemistry, 28.04.2021 21:00

Mathematics, 28.04.2021 21:00

Chemistry, 28.04.2021 21:00

Spanish, 28.04.2021 21:00