Business, 20.07.2019 21:00 1119diamondlord

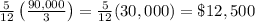

On june 1, aaron company purchased equipment at a cost of $120,000 that has a depreciable cost of $90,000 and an estimated useful life of 3 years and 30,000 hours. using straight-line depreciation, calculate the depreciation expense for the final (partial) year of service, which ends on december 31.

Answers: 1

Another question on Business

Business, 22.06.2019 15:00

(a) what do you think will happen if the price of non-gm crops continues to rise? why? (b) what will happen if the price of non-gm food drops? why?

Answers: 2

Business, 22.06.2019 17:30

If springfield is operating at full employment who is working a. everyone b. about 96% of the workforce c. the entire work force d. the robots

Answers: 1

Business, 22.06.2019 20:50

Which of the statements best describes why the aggregate demand curve is downward sloping? an increase in the aggregate price level causes consumer and investment spending to fall, because consumer purchasing power decreases and money demand increases. as the aggregate price level increases, consumer expectations about the future change. as the aggregate price level decreases, the stock of existing physical capital increases. as a good's price increases, holding all else constant, the good's quantity demanded decreases.

Answers: 2

Business, 22.06.2019 23:10

Until recently, hamburgers at the city sports arena cost $4.70 each. the food concessionaire sold an average of 13 comma 000 hamburgers on game night. when the price was raised to $5.40, hamburger sales dropped off to an average of 6 comma 000 per night. (a) assuming a linear demand curve, find the price of a hamburger that will maximize the nightly hamburger revenue. (b) if the concessionaire had fixed costs of $1 comma 500 per night and the variable cost is $0.60 per hamburger, find the price of a hamburger that will maximize the nightly hamburger profit.

Answers: 1

You know the right answer?

On june 1, aaron company purchased equipment at a cost of $120,000 that has a depreciable cost of $9...

Questions

Mathematics, 16.12.2020 05:40

Mathematics, 16.12.2020 05:40

English, 16.12.2020 05:40

Mathematics, 16.12.2020 05:40

Health, 16.12.2020 05:40

History, 16.12.2020 05:40

Social Studies, 16.12.2020 05:40

Mathematics, 16.12.2020 05:40

Chemistry, 16.12.2020 05:40

Mathematics, 16.12.2020 05:40

Mathematics, 16.12.2020 05:40

English, 16.12.2020 05:40