50 !

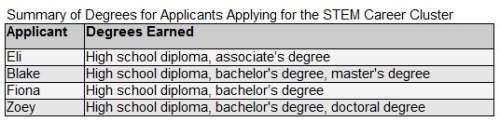

which best describes the jobs each applicant could obtain with their educational b...

Business, 08.12.2019 01:31 taniyahreggienae

50 !

which best describes the jobs each applicant could obtain with their educational background?

a)eli can work as an astronomer, blake can work as an agricultural engineer, fiona can work as a mathematician, and zoey can work as a conservation scientist.

b)eli can work as a civil engineer, blake can work as an aerospace engineer, fiona can work as a park naturalist, and zoey can work as a materials scientist.

c)eli can work as an electro-mechanical technician, blake can work as a biochemist, fiona can work as an industrial ecologist, and zoey can work as an archivist.

d)eli can work as an electronic engineering technician, blake can work as a museum conservator, fiona can work as a robotics engineer, and zoey can work as a mathematician.

Answers: 3

Another question on Business

Business, 22.06.2019 03:10

Complete the sentences. upper a decrease in current income taxes the supply of loanable funds today because it a. decreases; increases disposable income, which decreases saving b. has no effect on; doesn't change expected future disposable income c. decreases; decreases expected future disposable income d. increases; increases disposable income, which encourages greater saving upper a decrease in expected future income a. increases the supply of loanable funds today because households with smaller expected future income will save more today b. has no effect on the supply of loanable funds c. decreases the supply of loanable funds because it decreases wealth d. decreases the supply of loanable funds today because households with smaller expected future income will save less today

Answers: 3

Business, 22.06.2019 10:10

Rats that received electric shocks were unlikely to develop ulcers if the

Answers: 1

Business, 22.06.2019 13:10

Trey morgan is an employee who is paid monthly. for the month of january of the current year, he earned a total of $4,538. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year, and the fica tax rate for medicare is 1.45% of all earnings for both the employee and the employer. the amount of federal income tax withheld from his earnings was $680.70. his net pay for the month is .

Answers: 1

Business, 22.06.2019 17:00

Which represents a surplus in the market? a market price equals equilibrium price. b quantity supplied is greater than quantity demanded. c market price is less than equilibrium price. d quantity supplied equals quantity demanded.

Answers: 2

You know the right answer?

Questions

Mathematics, 17.10.2019 02:10

Mathematics, 17.10.2019 02:10

Mathematics, 17.10.2019 02:10

History, 17.10.2019 02:10