Answers: 1

Another question on Business

Business, 22.06.2019 03:00

Which of the following is an effective strategy when interest rates are falling? a. use long-term loans to take advantage of current low rates. b. use short-term loans to take advantage of lower rates when you refinance a loan. c. deposit to a short-term savings instrumentals to take advantage of higher interest rates when they mature. d.select short-term savings instruments to lock in earnings at a current high rates.

Answers: 1

Business, 22.06.2019 13:00

Apopular low-cost airline, parson corp., has gone out of business. although the service and price provided by the airline was what customers wanted, the larger airlines were able to drive the low-cost airline out of business through an aggressive price war. which component of the competitive environment does this illustrate? a) threat of new entrants b)competitors c) economic factors d) customers d) regulators

Answers: 1

Business, 22.06.2019 17:10

At the end of the current year, accounts receivable has a balance of $550,000; allowance for doubtful accounts has a credit balance of $5,500; and sales for the year total $2,500,000. an analysis of receivables estimates uncollectible receivables as $25,000. determine the net realizable value of accounts receivable after adjustment. (hint: determine the amount of the adjusting entry for bad debt expense and the adjusted balance of allowance of doubtful accounts.)

Answers: 3

Business, 22.06.2019 19:50

On july 7, you purchased 500 shares of wagoneer, inc. stock for $21 a share. on august 1, you sold 200 shares of this stock for $28 a share. you sold an additional 100 shares on august 17 at a price of $25 a share. the company declared a $0.95 per share dividend on august 4 to holders of record as of wednesday, august 15. this dividend is payable on september 1. how much dividend income will you receive on september 1 as a result of your ownership of wagoneer stock

Answers: 1

You know the right answer?

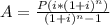

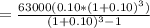

Prepare an amortization schedule for a three-year loan of $63,000. the interest rate is 10 percent p...

Questions

Mathematics, 05.03.2021 23:40

Mathematics, 05.03.2021 23:40

English, 05.03.2021 23:40

Mathematics, 05.03.2021 23:40

Mathematics, 05.03.2021 23:40

Mathematics, 05.03.2021 23:40

Physics, 05.03.2021 23:40

Mathematics, 05.03.2021 23:40

Mathematics, 05.03.2021 23:40

Biology, 05.03.2021 23:40

Mathematics, 05.03.2021 23:40

Computers and Technology, 05.03.2021 23:40

Mathematics, 05.03.2021 23:40

Chemistry, 05.03.2021 23:40

Mathematics, 05.03.2021 23:40

Mathematics, 05.03.2021 23:40