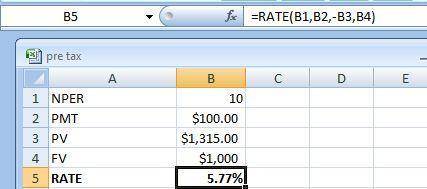

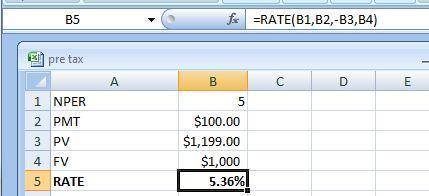

This question illustrates the effects of time to maturity on a bond’s yield to maturity. Tindall Enterprises has two outstanding bonds. Both bonds are risk-fee, both pay 10.00% annual coupons, both have face values of 1000, and both bonds just made a coupon payment; however, bond A matures in 10 years and bond B matures in 5 years. Given that the price of bond A is $ 1,315 and the price of bond B is $ 1,199, how much bigger is the yield-to-maturity of bond A than the yield-to-maturity of bond B? Enter your answer as a perecent without the "%"; round your final answer to two decimals

Answers: 1

Another question on Chemistry

Chemistry, 21.06.2019 21:30

The reaction q+r2=r2q is found to be first order in r2 and

Answers: 1

Chemistry, 22.06.2019 00:00

How many liters of water vapor can be produced if 108 grams of methane gas (ch4) are combusted at 312 k and 0.98 atm? show all work. pls ! will mark as brainliest

Answers: 1

Chemistry, 22.06.2019 04:00

Write the empirical chemical formula of calcium with a mass percent of 38.8, phosphorus with a mass percent of 20.0, and oxygen with a mass percent of 41.3.

Answers: 1

Chemistry, 22.06.2019 14:30

How does a noncompetitive inhibitor reduce an enzyme’s activity?

Answers: 1

You know the right answer?

This question illustrates the effects of time to maturity on a bond’s yield to maturity. Tindall Ent...

Questions

Mathematics, 14.10.2019 20:00

Computers and Technology, 14.10.2019 20:00

Advanced Placement (AP), 14.10.2019 20:00

English, 14.10.2019 20:00

Physics, 14.10.2019 20:00

Mathematics, 14.10.2019 20:00

History, 14.10.2019 20:00

Mathematics, 14.10.2019 20:00