Please help, im very confused.

A certain state uses the following progressive

tax rate for ca...

Law, 30.03.2021 21:20 hernandezaniyah660

Please help, im very confused.

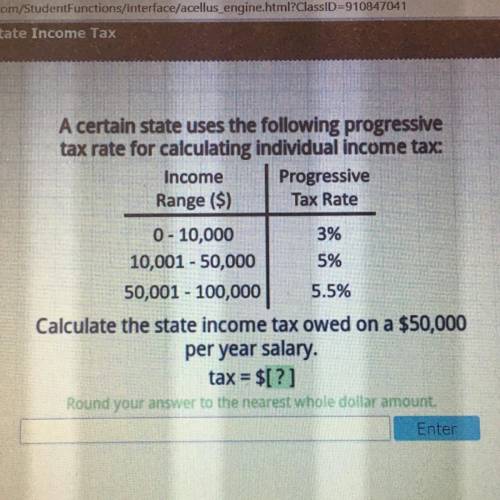

A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($) Tax Rate

0 - 10,000

3%

10,001 - 50,000 5%

50,001 - 100,000 5.5%

Calculate the state income tax owed on a $50,000

per year salary.

tax = $[?]

Round your answer to the nearest whole dollar amount.

Answers: 1

Another question on Law

Law, 13.07.2019 03:30

Question #22 when you approach an intersection with a green traffic light, you should choose an a. approach at a speed that will allow you to stop if the light changes. b. be ready to speed up if the light turns yellow. c. always slow down by a few miles per hour, in case you need to stop.

Answers: 1

Law, 14.07.2019 10:10

The texas department of public safety issues driver's licenses and identification cards that have specific security features. a valid driver's license issued after april 2009 has which of the following features on the front of the card?

Answers: 2

You know the right answer?

Questions

Mathematics, 26.01.2021 16:40

Biology, 26.01.2021 16:40

Mathematics, 26.01.2021 16:40

History, 26.01.2021 16:40

Mathematics, 26.01.2021 16:40

History, 26.01.2021 16:40

Mathematics, 26.01.2021 16:40

English, 26.01.2021 16:40

Computers and Technology, 26.01.2021 16:40

Mathematics, 26.01.2021 16:40